Allow me to share with you 10 Free Sample Cash Log Templates to help you prepare your own Cash Log quickly but effectively.

It can be very beneficial for the person to use the cash log while handling small cash purchases. Those companies or organizations that have to deal with small quantities of easily available supplies can use the cash log easily. You can also check out these Editable Payment Voucher Templates as an alternative to suit your situation.

A Cash Log is extremely useful when the company has to deal with small purchases. The cash log can be made an important part of the cash fund where the company stores the sum of money which it spends on inexpensive items. There are some purchasers who do not feel easy to use credit cards and they do not accept cash through credit cards. For such kinds of purchasers, one is required to use the cash log.

Using Cash Log Templates

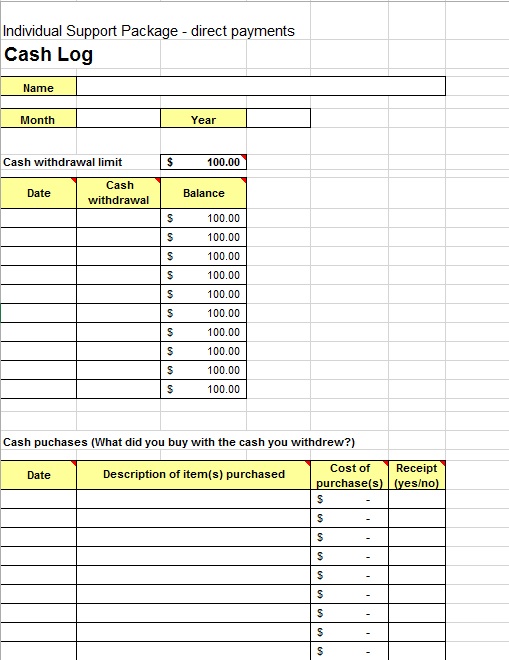

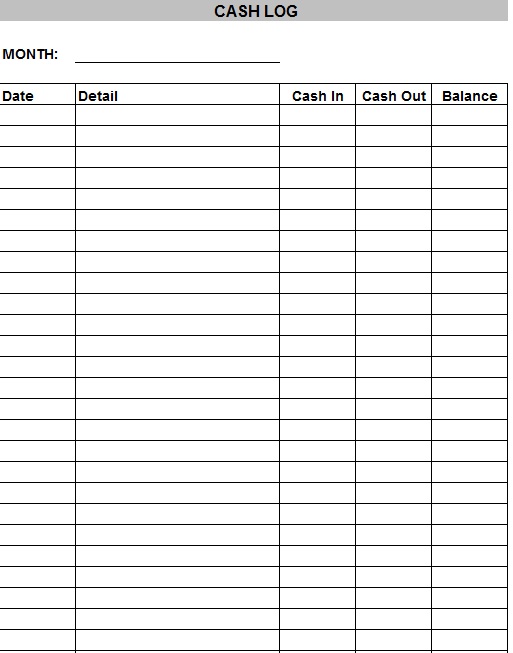

When you sell your product to someone and you have not received the money from the buyer yet, then that amount of money will also be stored in the cash log. It helps the person keep track of all the cash which is yet to come. This also records the money that you paid to your employees and to other people. It lets you know about all of the expenditures which you have made throughout the month and also the dates of those expenditures.

At the end of the month, you can total the money which you have paid to the people and also the money which you have received from your clients. In this way, you can estimate whether you got a profit in the month or a loss.

A cash log is used to record the transactions which are truly legitimate. When you have the log where you can store your legitimate money which you have received and paid, then you are able to claim those expenses as the deduction. The cash log is very important in accounting as it accelerates the flow of cash. You can make your customers pay you with the help of a cash log.

It is a little bit complicated to know about those purchases which are suitable for the cash log accounting. It also becomes very useful for companies which have a large-scale progress in the market and have to deal with a lot of money transactions. When the number of money transactions increases in size, it becomes very difficult for an accountant to keep track of all those transactions. Using a cash log, in that case, becomes easy.

Every company makes many expenses such as shipping charges, stamp charges, and many other extra charges. When you write a check for all those items, it takes too much time and is also very expensive. When the companies maintain a cash log, then it becomes easy for them to handle to account for the expenditures with minimum cost.

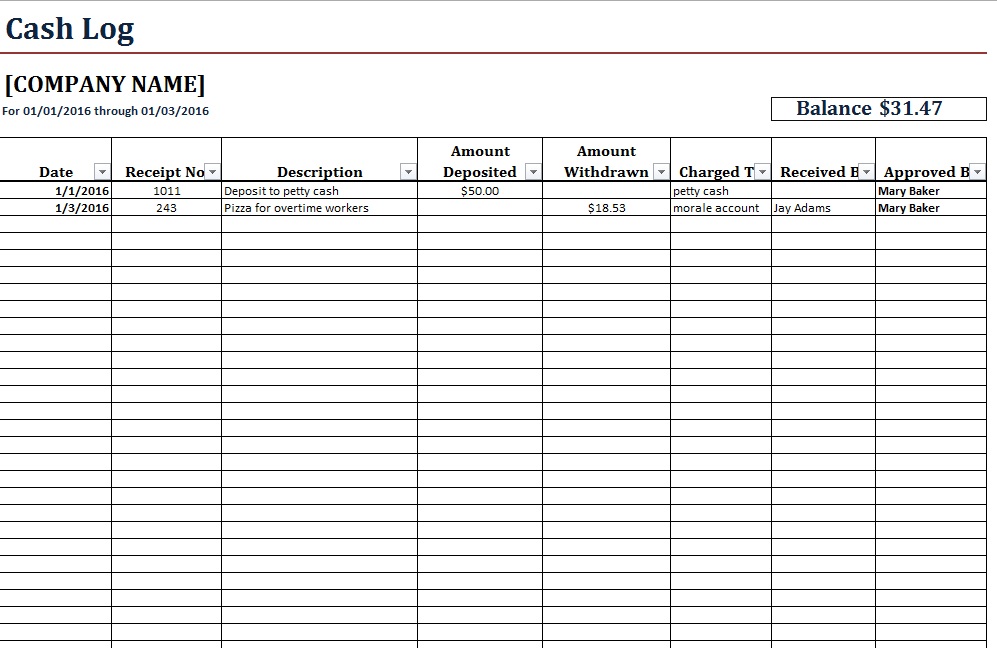

Download Free Cash Log Templates

A Cash Log can be an online spreadsheet that is kept up to handle the transactions. Each kind of cash should be recorded in the log. The description of each cash log is also included in the log. It helps the person to know about each cash flow.

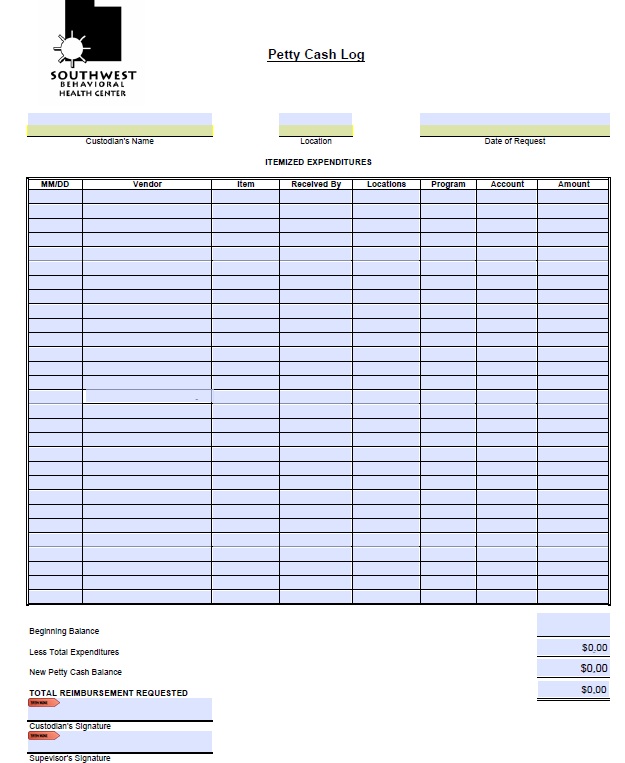

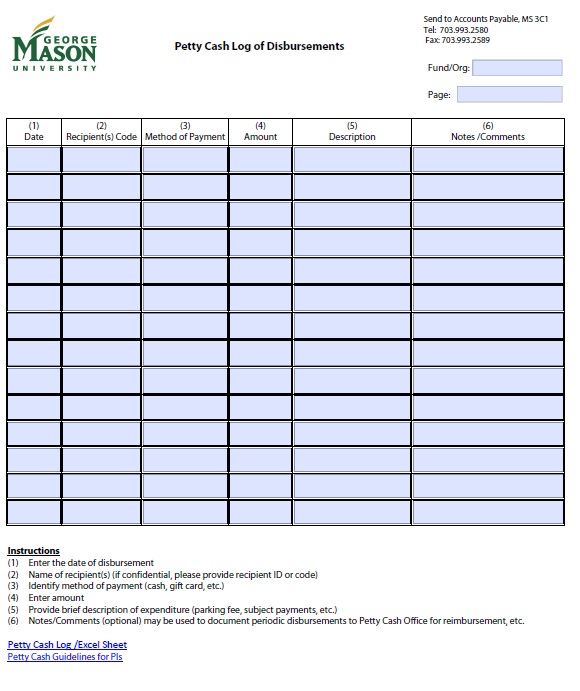

Open Office Petty Cash Log Template

File Type: OpenOffice Format {ZIP File}

File Size: 178 KB