Download these 20 Free Payment Voucher Templates & Format in order to study them and then create and print your own Payment Voucher effectively. You can also download Cash Voucher Templates and Petty Cash Voucher Templates from our website for free.

A payment voucher is employed in the business and accounting settings to document the particulars of a monetary transaction, mainly to note payments made to vendors, employees, or contractors. It is additional confirmation that Upper management authorized such payment and that it was made to someone’s account showing obvious signs of such financial practices, understood as internal controls, within the organization. Therefore, payment vouchers are very important for bookkeeping as well as internal control purposes that finance faces.

What is a Payment Voucher?

A payment voucher is a formal document used in business and accounting to record the details of a financial transaction, particularly payments made to suppliers, employees, or service providers.

In accounting frameworks, payment voucher serves as an aid to prevent unauthorized payments since it requires every payment made to be evidenced by a reason and documentations. Therefore, it assists in reducing omissions, and circumvents fraud, misappropriation of funds, facilitating in turn record keeping, and standard reporting procedures.

Contents

Key Components of a Payment Voucher

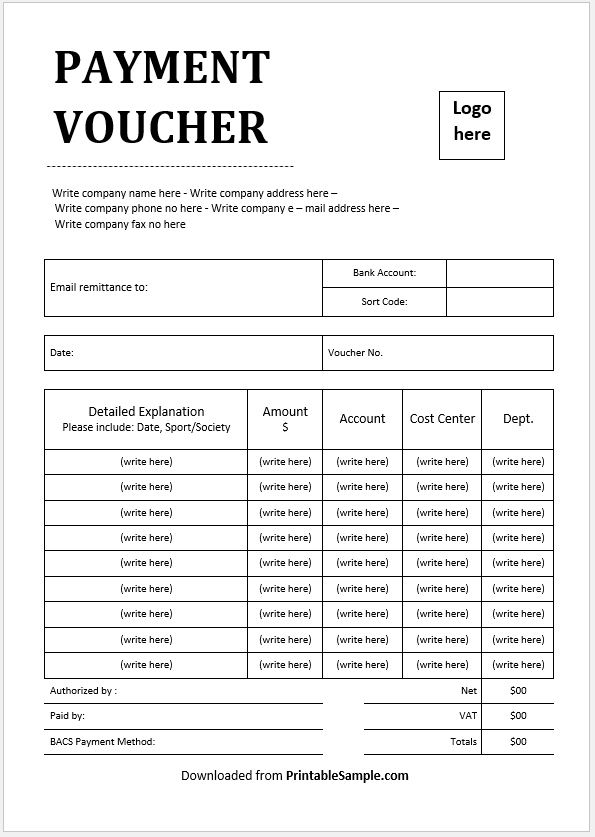

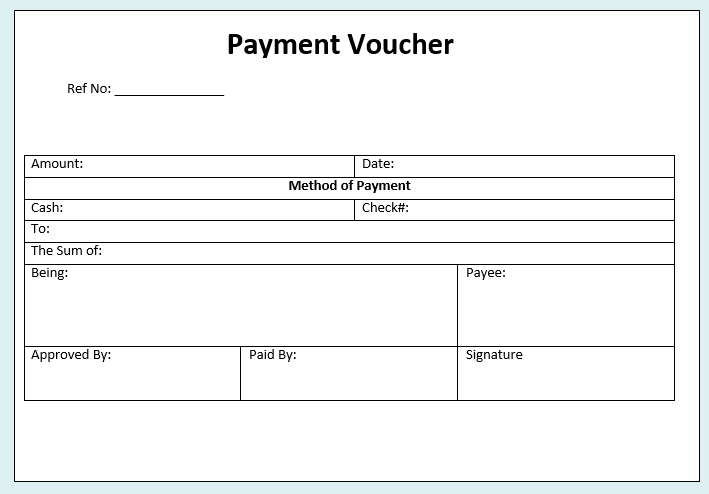

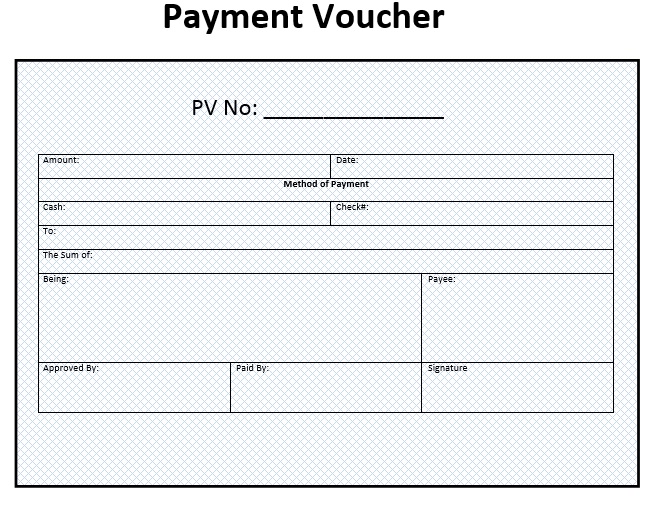

It is very important that a payment voucher is legible and formatted in the way that guarantees accurate and effective accounting. All the elements of the voucher are important as they enable the confirmation of the transaction by both the drawer and the voucher bearers, and they provide a clear guide in case of a check or a report. The presence and the unchangeable position of the necessary elements in payment vouchers assure the harmony of the financial processes and reduces possible mistakes.

Essential Elements:

Each payment voucher comes with a set of primary information concerning the transaction. The payment date will show the day of recording the payment obligations, whereas the serial number of the voucher makes the documentation easy to follow or allows checking records within the computerized system. It is necessary to indicate the name of the recipient, his/her company or department completely and correctly, for the purpose of directing funds appropriately. It is worth remembering that, in a printed format, the value of the payment does and should appear both in figures and words, so that neither misunderstood nor tempered with.

Significance of Authorization Signatures and Supporting Documents

It is impossible to imagine any financial process without authorization, especially since a payment voucher has to be approved by an appropriate personnel. Normally, this means having the payment voucher signed by a responsible person; most of the time this will be the person who prepared it, the person who checked and the person who approved it and this serves to confirm that the payment is acceptable in the given situation and does not go against any policies in place. Most often, also, the voucher is submitted with a corresponding set of documents – invoice or purchase order – and receipts, which are included as justification for the payment and the entire amount claimed.

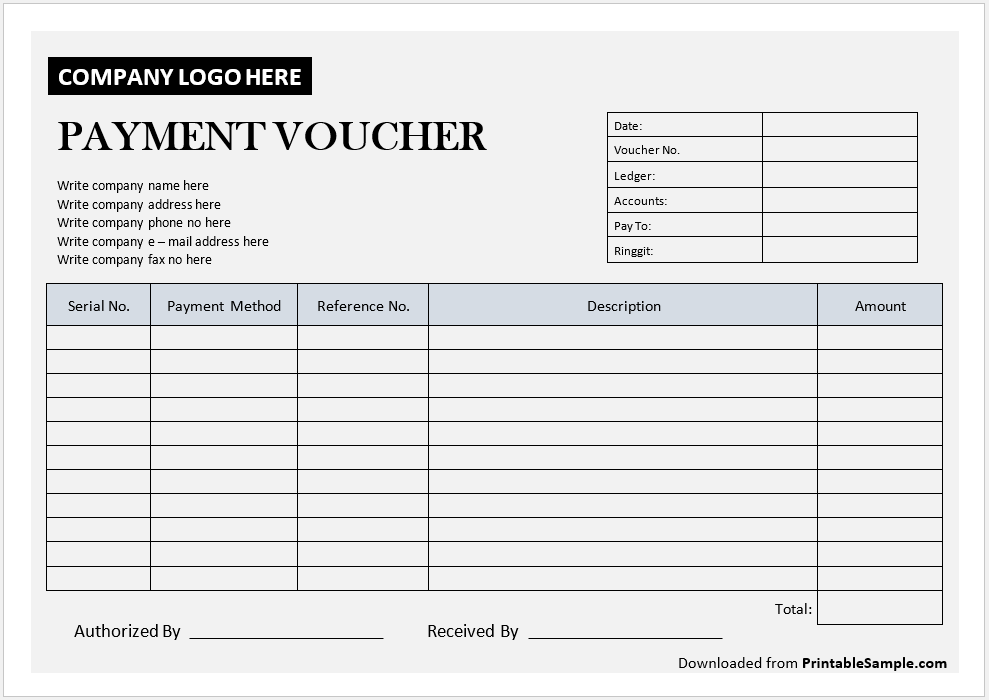

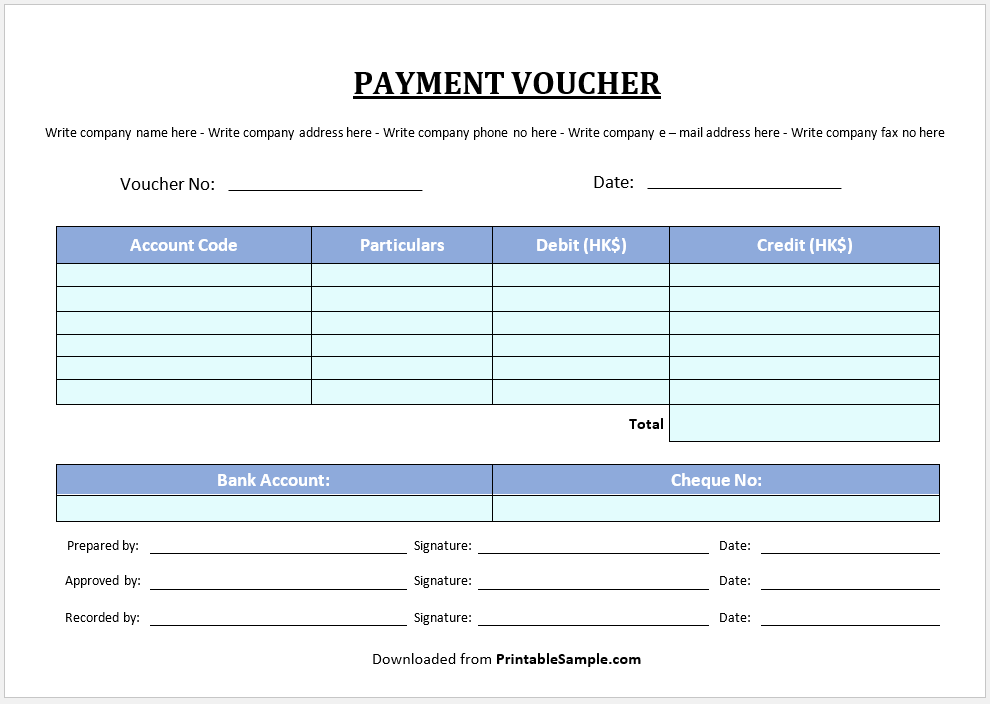

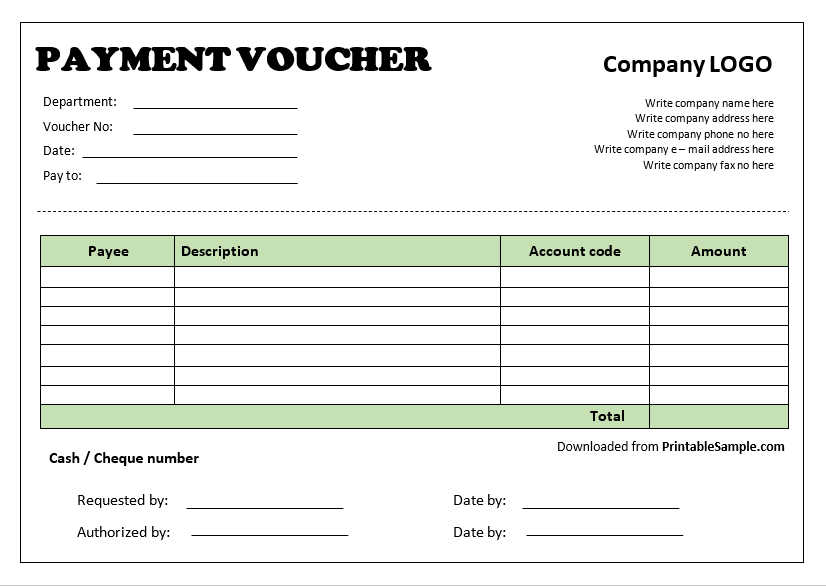

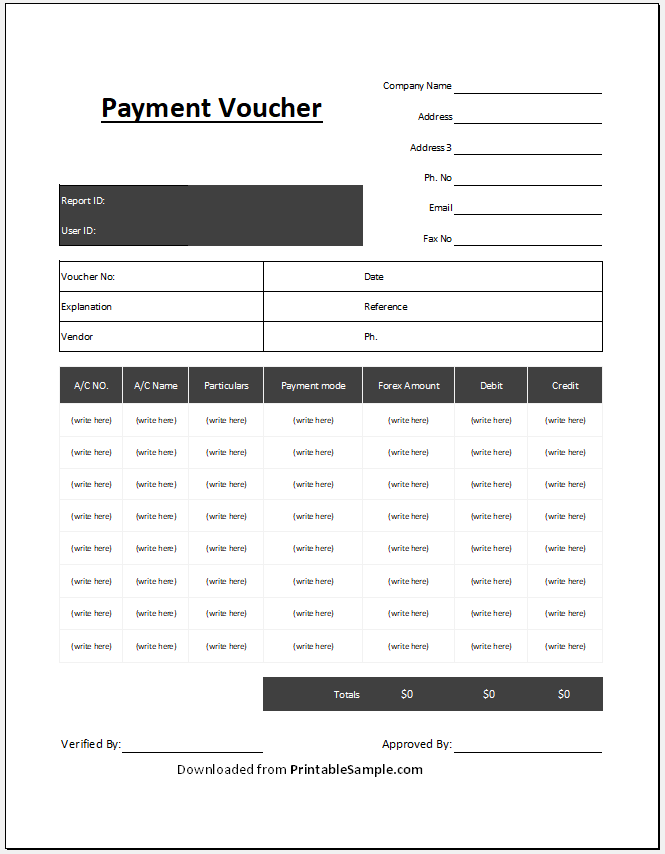

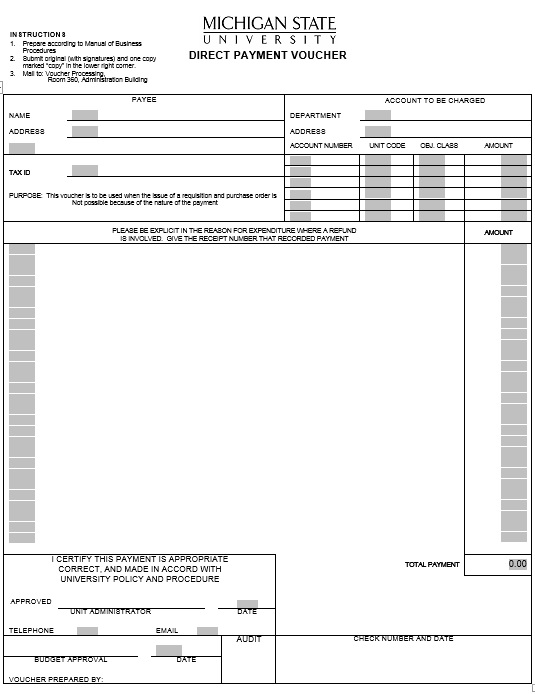

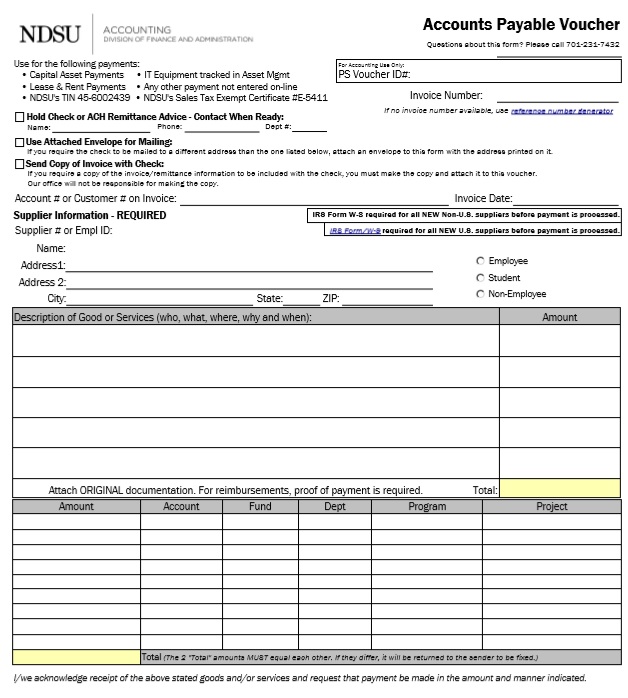

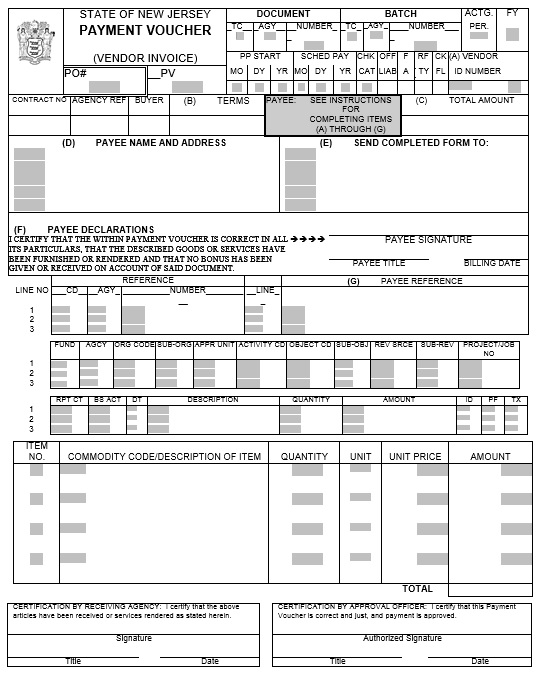

Free Payment Voucher Templates

Here are previews and download links for these free Payment Vouchers using MS Word, MS Excel and PDF format.

Types of Payment Vouchers

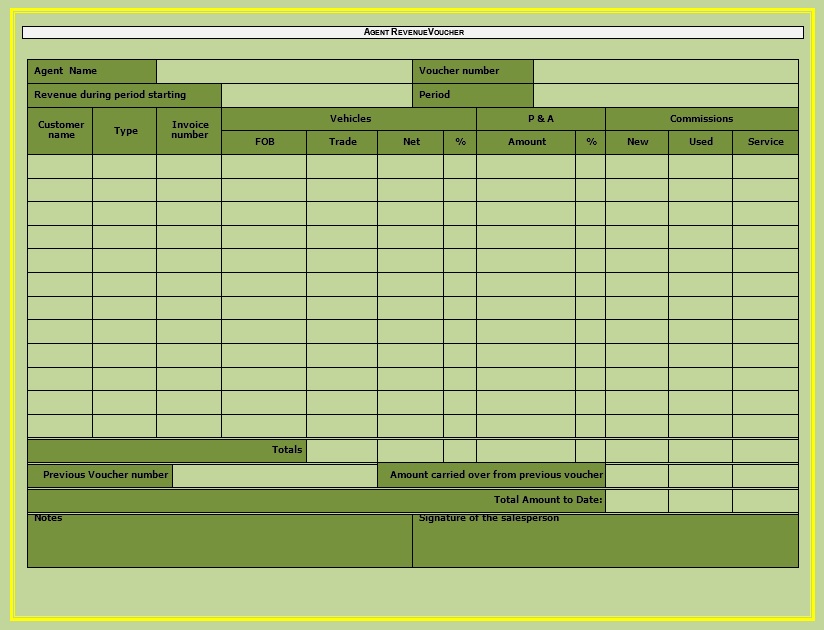

A payment voucher falls into one among the many types depending on the purpose of transaction and the mode of payment used. Every type is prepared for recording and documenting respective situations of payments in the accounts of the enterprise. Knowing these various types of payment vouchers enables the enterprise to keep records and keep things in order on the inside, and to also ensure that the accounting rules are not flouted.

Cash Payment Vouchers

Cash payment vouchers come into play when a payment is made in cash over the counter. Such vouchers are used in cases of every day, routine expenses including small purchases such as stationery, subsidiary travel expenses, petty cash released expenses etc. The cash payment voucher provides insert_documentation_evidence_1 of actual cash emphasizes and enables contain receipts or vouchers for bills payment purpose. The payment of such allowance is also supported by a specimen signature of the recipient of the funds and the person authorising the payment.

Bank Payment Vouchers

A bank payment voucher refers to the paperwork completed when making any kind of payment through the banking system i.e., via a bank transfer, check, deposit etc. Such payment voucher consists of bank details along with the payment reference and any other messages required in the transaction. Bank payment voucher is very important when dealing with huge amounts of money and payments which happen frequently such as vendors, utility bills, contractors etc. as they ensure there is an outflow cash track from the business accounts.

Expense Reimbursement Vouchers

As already mentioned, payment voucher is an attachment to the invoice, allowing both submission and payment of expense reimbursement. Vouchers are often used in payment of expenses and sometimes income received within a certain period. The voucher also states the amount spent, who the money was spent on, why, additional receipts and expense claims. This particular payment vouchers helps in controlling the management and is issued to ensure the validity of claims and reimbursements.

Salary and Advance Payment Vouchers

A salary payment voucher should be issued each time the workers’ salaries are paid, as it ensures that all authorization requirements are followed and that records of salaries paid are carefully kept. They could be accompanied by deductions and bonuses and in most cases a net salary. On the contrary, advance payments payment vouchers are prepared whenever there is payment before the performance of work or services by the supplier in question or employee concerned. This will be settled with the invoices and credits within the next invoices, which is quite essential whilst handling advance payments and prepayment mutilations.

Standard Formats of Payment Vouchers

One of the most important elements that make a good payment voucher is the format in which it will appear. The reason for this is mainly because every finance department’s policies dictate that certain documents purporting to pay off debts be made in writing. Such standards are necessary to prevent confusion and ensure the orderly state of affairs. On the other hand, some companies could have a wide range of departments within which various payment vouchers could be implemented. While the shape of these vouchers may vary, the format is similar in most cases since one particular layout is used for most payment vouchers.

Overview of Commonly Used Formats

Most traditional payment voucher layouts have an organized field distribution with fields like the voucher number, issue date, beneficiary, amount payable, choice of payment, reason for the payment, and approval signatures. This purposeful organization allows for the easy interpretation and validation of the transaction to be done chronologically. Several organizations utilize spreadsheet, word processing or accounting software templates of this nature for the purposes of efficient input and data analysis.

Adaptability to Organizational Needs

While the standard template is usually constant, every business might very well have its own specific customizations regarding the payment voucher format. For instance, certain firms could account for factors such as project codes, department numbers and even taxation policies. However, the advantage of such confidential informality is that payment vouchers can be affiliated into any strategic financial activities that may exist extraordinary.

Customizing Payment Voucher Templates for Your Business

It is critically important to enhance existing payment voucher templates in accordance with a company’s core values, organizational policies and regulatory obligations. Although pre-tailored examples help minimize efforts, customizing the template according to standard rules and aesthetics of the particular organization guarantees that all payment vouchers are handled in an orderly manner.

Incorporating Company Branding Elements

It’s a proven fact that the customization of the payment voucher template has been achieved by including branding elements. These include – logos, colors, and typefaces – where the latter two are coordinated with the visual identity of the person’s company. These features serve two purposes; one, they make the document look impressively neat and official, and two, they help maintain brand consistency. Brand consistency is indeed quite crucial in cases where such payment vouchers have to be distributed to the non-company individuals or companies such as suppliers, customers and banks.

Modifying Fields to Capture Specific Information

Every business has its own set of needs, and having a template for customization means you can incorporate all fields that will be of relevance in every business process. This may include fields for project codes, tax numbers, payment categories and even approvals from departments. Also, a provision for customized templates for payment voucher types, for instance cash or bank or advance payment for many will also help the financers assist in the transactions in a systematic and precise manner.

Ensuring Compliance with Legal and Financial Standards

Adapting the design of a voucher template also means ensuring that there is compliance with the prevailing laws and regulations. This involves proper formatting for purposes of financial auditing, descriptions, necessary fields for example authorization signatures, supporting document checklists, and terms of payment vouchers. With these in mind, your payment voucher will function as an effective internal control and helps easy reporting, hence adhere to the regional and industry-specific regulations.

Best Practices for Managing Payment Vouchers

One key aspect of financial management is the proper management of vouchers. This allows for efficiency in the auditing process, transparency of finances, and accountability of the transactions involved. Every payment voucher is proof of funds released in respect to any expense incurred. It is important to note that payment vouchers go a long way to establish the audibility of the organization’s account. There are certain ways through which it is possible to manage such vouchers in the best possible way. In this way, the profits get increased while at the same time, the probability of any loose ends with the finances gets decreased.

Implementing a Systematic Approach to Creation, Approval, and Storage

To regulate a payment voucher, the best safeguarding is to implement a management system. This is repeating a cycle of interdependent activities: creating a draft, reviewing the draft, approving the drafted plan, and storage of approved direction for preservation. This means that the management activities should include the use of templates that are already approved, allocation of preparation to a named person, and each payment voucher being checked against the supporting evidence before being approved. It should have specific points where approval is doubled or external to the unit that is implementing the activity in order to encourage good practices. Well-stored filing of Vouchers, either paper based or electronic filing, will ease and facilitate inspections for example, periodic audits, assessment of information, or cabinet investigations.

Maintaining Accurate Records for Auditing and Analysis

Each payment voucher should be properly documented since these documents will contain, among other details such as the date of the transaction or the voucher code or method of payment together with respective supporting documents (bills invoices). Because when all the payment vouchers are kept in an orderly file it simplifies both internal and external auditing processes. As well, it makes the available financial information more beneficial and useful in the sense that expenses can specifically be broken down into various categories, purchases to suppliers ‘can be monitored and recorded, and expenditure trends can be established over a given period. Proper record keeping is useful for strategic budgeting and planning as well as for the purposes of meeting various legal requirements.

Regular Review and Updating of Templates and Processes

To ensure that the voucher system is relevant and effective in relation to business operations as they are currently, firms should periodically revise the voucher template and outstanding voucher protocols. This in particular involves omitting a template that no longer meets the existing regulatory framework for a payment voucher, provides all the required fields for a payment voucher and also does not fit in with digital accounting systems. Incorporation of such changes into the template due to for instance variations in taxation, organizational restructuring or modification of report formats, enables standardization and avoids any potential discrepancies within the financial documents.

Incorporating these guiding principles positively impacts the organization of payment voucher mechanism, minimizes overhead costs, and supports the establishment of ethical business practices. The proper organization of a payment vouchers is a reflection of the experience, integrity and reliability of the company not only in the eyes of its partners, but also in the view of the external auditors and supervisory bodies.