A Promissory Note is a debt document that incorporates legal binding to pay another person, or party, whether asked on demand or to pay on some future date under the agreed terms and conditions. It is a payable note that includes and documents the promise of paying the money back on the decided date in full, or in installments. Moreover, this legally designed instrument highlights the following crucial elements to protect the rights of both the borrower and the lender to avoid future ambiguities:

- Loan amount

- Calculated interest rate.

- Maturity date on which the amount of the loan will be repaid.

- The procedure of prepayment.

- State Law regarding the promissory note.

- Amendments

- Signature of Both Parties

Contents

- Definition and Purpose of Promissory Notes

- Importance in Personal and Business Transactions

- Key Components of a Promissory Note

- Free Promissory Note Templates {Exclusive}

- Types of Promissory Notes

- More Free Promissory Note Examples

- When to Use Promissory Notes

- How to Draft a Promissory Note?

- Legal Implications and Enforceability

- Alternatives to Promissory Notes

- Best Practices for Using Promissory Notes

- Author

Definition and Purpose of Promissory Notes

A promissory note serves as a written commitment by the borrower to repay a loan within a specified timeframe, usually with an agreed-upon interest rate. It includes core details such as the amount borrowed, payment schedule, due date, and any applicable penalties or provisions for early repayment or default. Unlike informal IOUs, promissory notes are more structured and carry legal weight, allowing the lender to enforce repayment through legal channels if necessary.

Importance in Personal and Business Transactions

In the context of personal lending, promissory notes give a clear record of the agreement, which prevents misunderstandings between comrades, family members, or acquaintances. In commercial contexts, these documents are vital for managing short-term loans, supplier credit, or internal financing arrangements. Their use guarantees that the parties are on the same page regarding loan terms, thus bolstering professionalism and legal clarity. A promissory note, by documenting the transaction, promotes financial planning, functioning as a reference for both lender and borrower during the lifetime of the loan.

Key Components of a Promissory Note

A good promissory note must contain certain elements that name the terms of the loan agreement clearly and make it enforceable by law. These elements provide a means by which both lender and borrower will set their expectations of each other; they also provide a means for settling disputes that may arise in the life of the agreement. A complete set of promissory notes helps everyone understand what is going on. It eliminates ambiguity and gives the lender and borrower security and assurance.

Essential Elements:

The most essential element of the promissory note is whomever the parties involved are, that is, the parties agree to lend the money, including the one who borrows the money and the one who gives it. The promissory note also states the amount to be paid, which is the principal sum borrowed. The promissory note indicates the principal amount and includes the details of the interest rate agreed upon to be paid-not just that, but it also has to indicate whether the interest is fixed or variable and how it should be calculated through time.

Furthermore, one aspect just as important is repayment terms, which establish periodicity and amounts-in terms of total repayment schedule. The installments or repayment in a single sum may differ depending upon the agreement’s nature. A critical component of the note is the maturity date, which states the day when the last payment becomes due and payee obligations are expected to end.

Legal Considerations and Enforceability

In unenforceable species, a promissory note is one that has not been clearly set forth in writing, one that has not been signed by the borrower, or one that does not contain other particulars required by law. Such properly executed promissory notes are binding contracts to assist in collection and legal proceedings in case of default in payment.

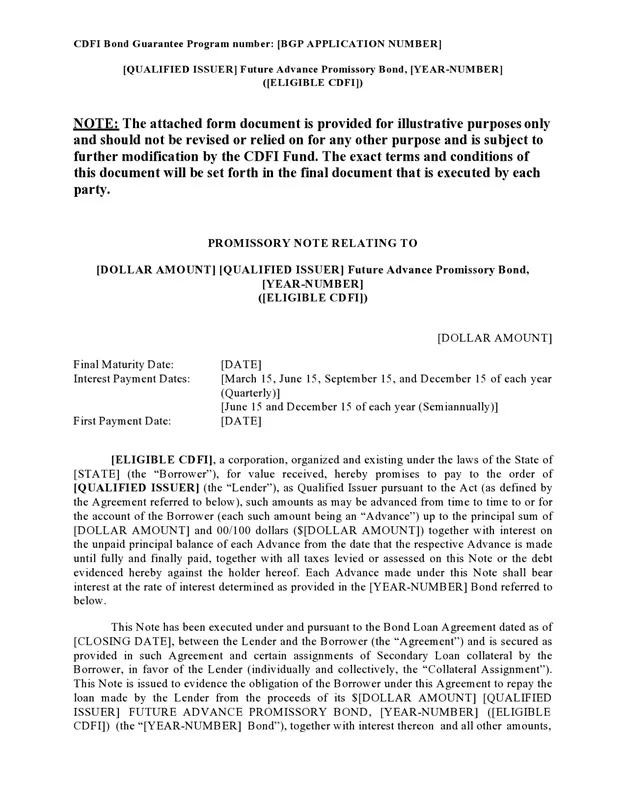

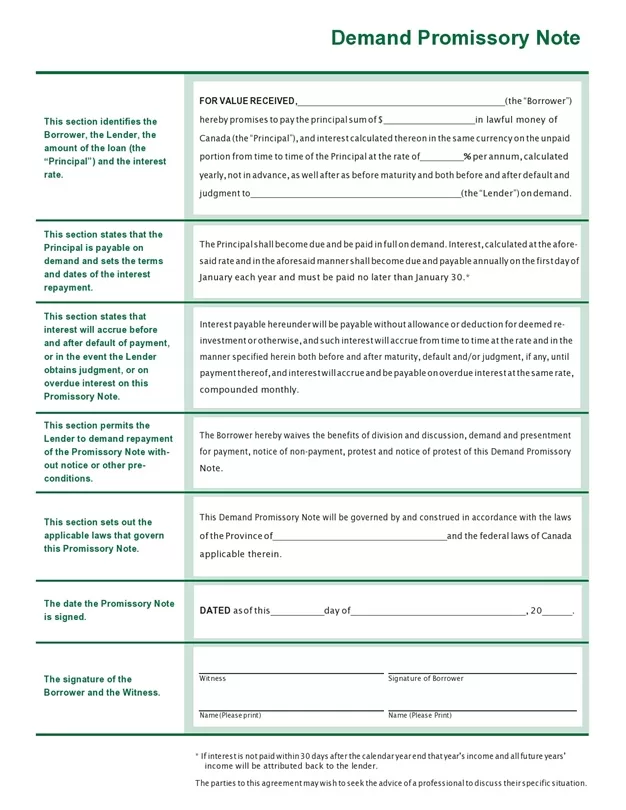

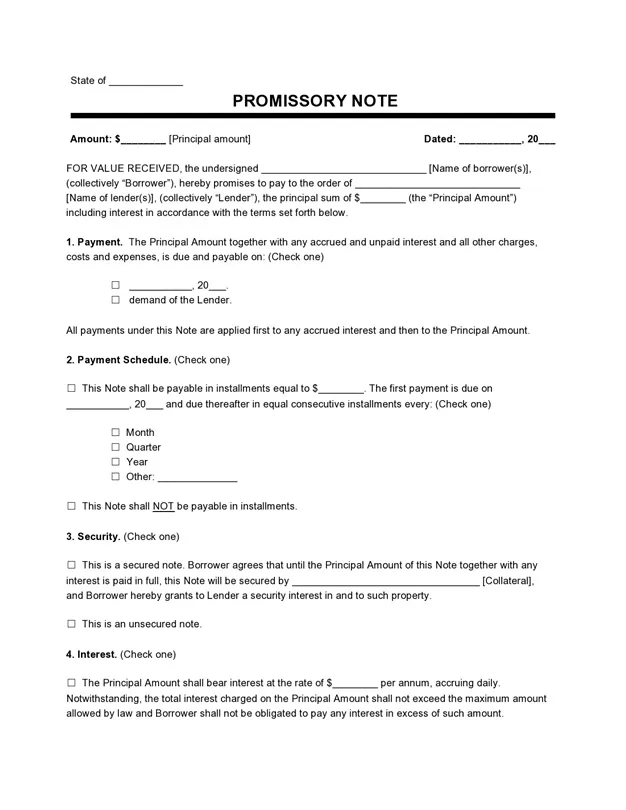

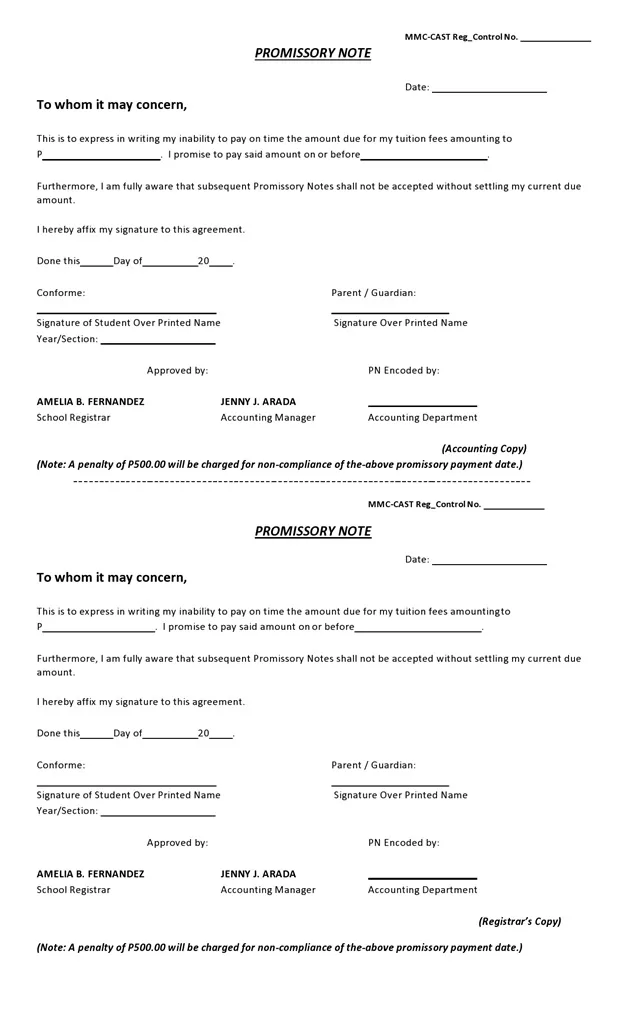

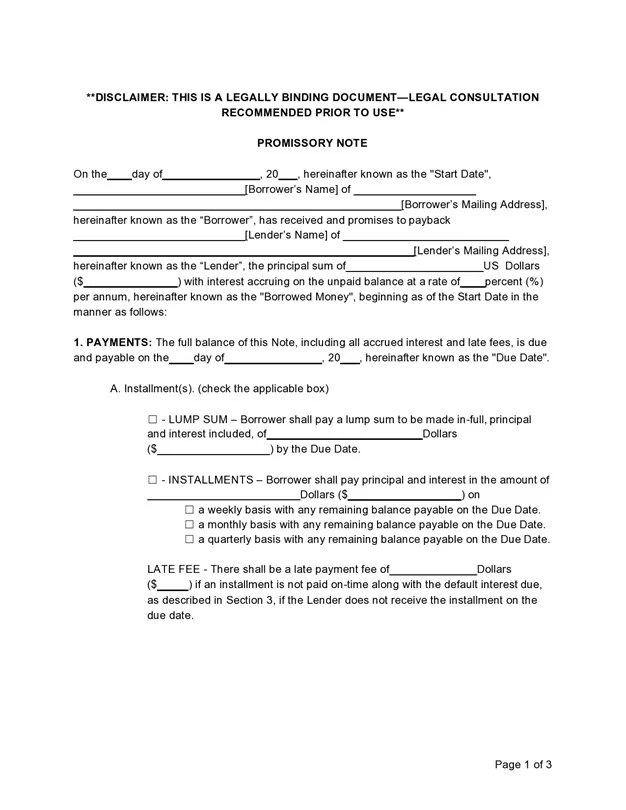

Free Promissory Note Templates {Exclusive}

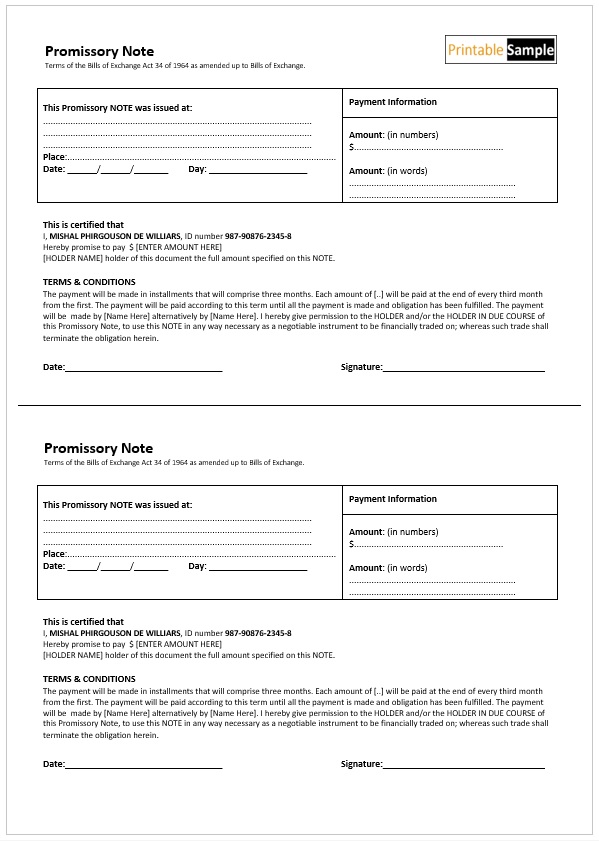

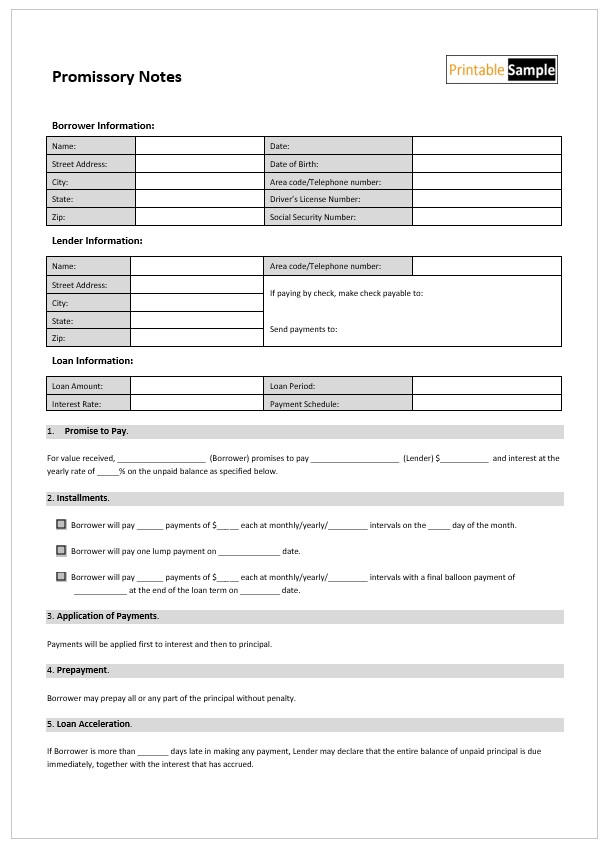

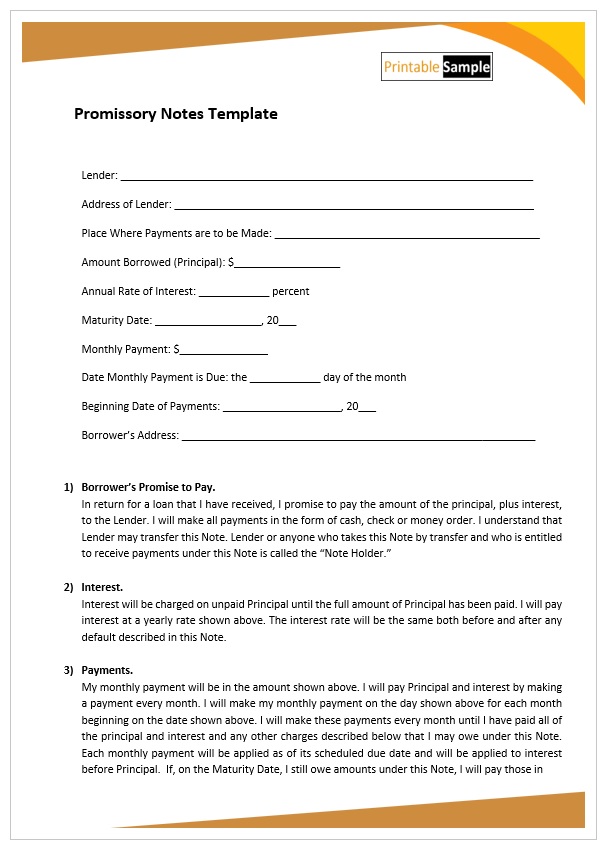

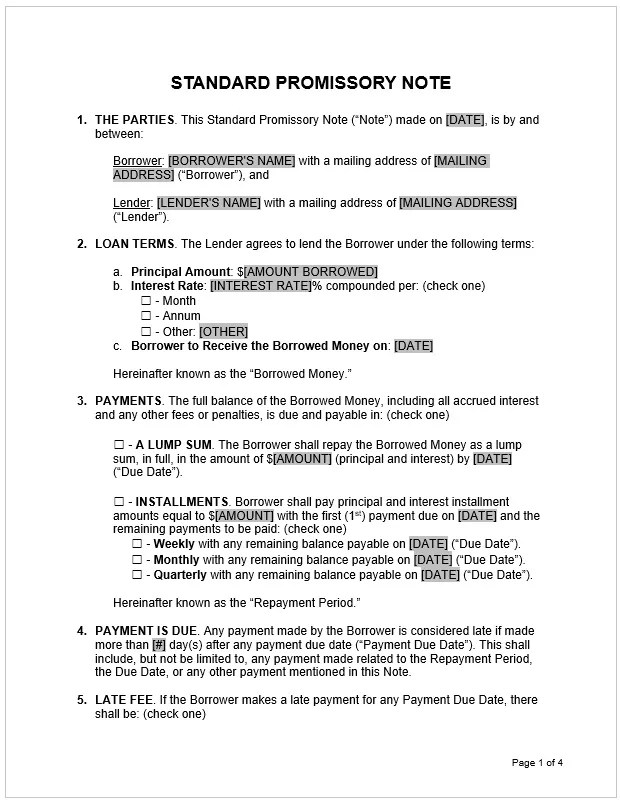

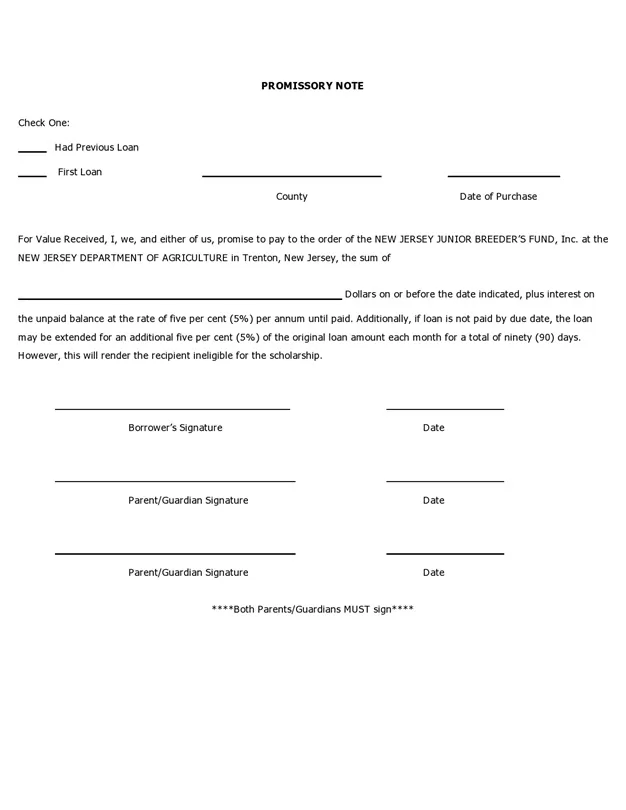

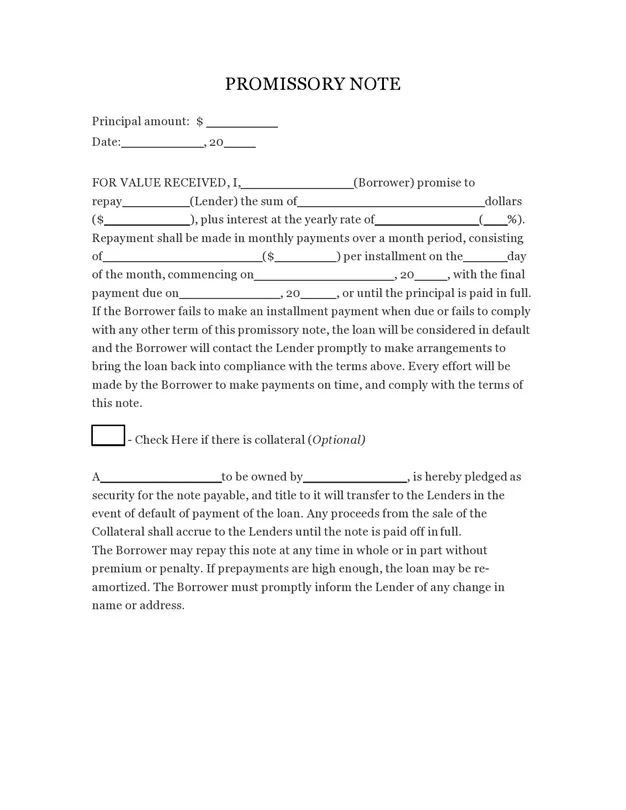

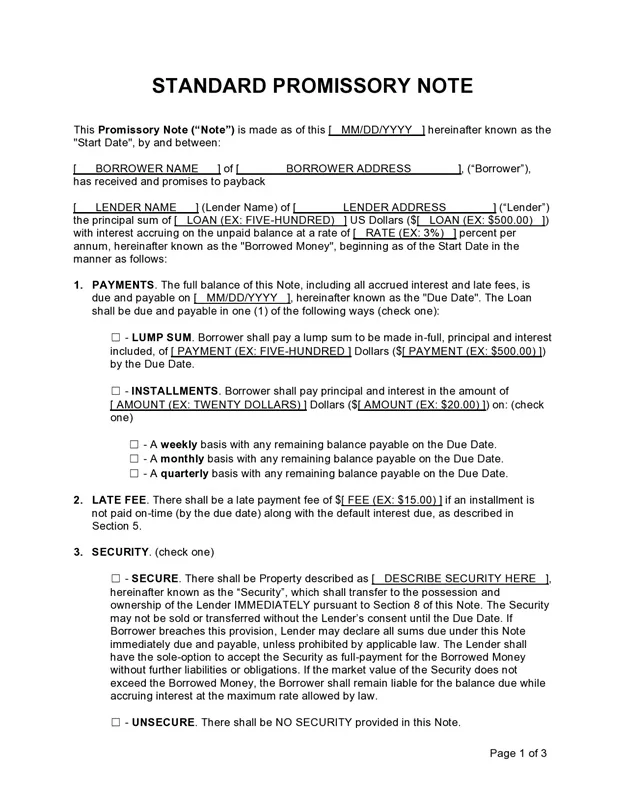

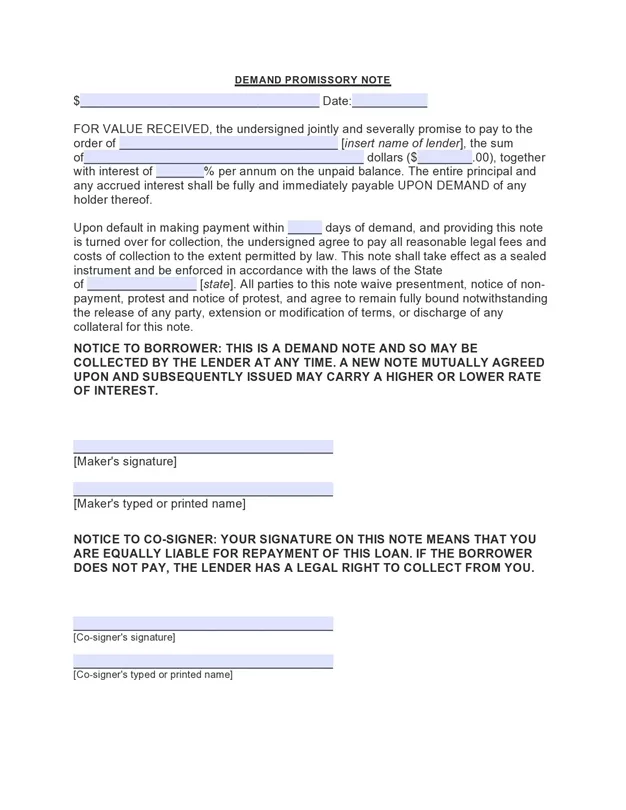

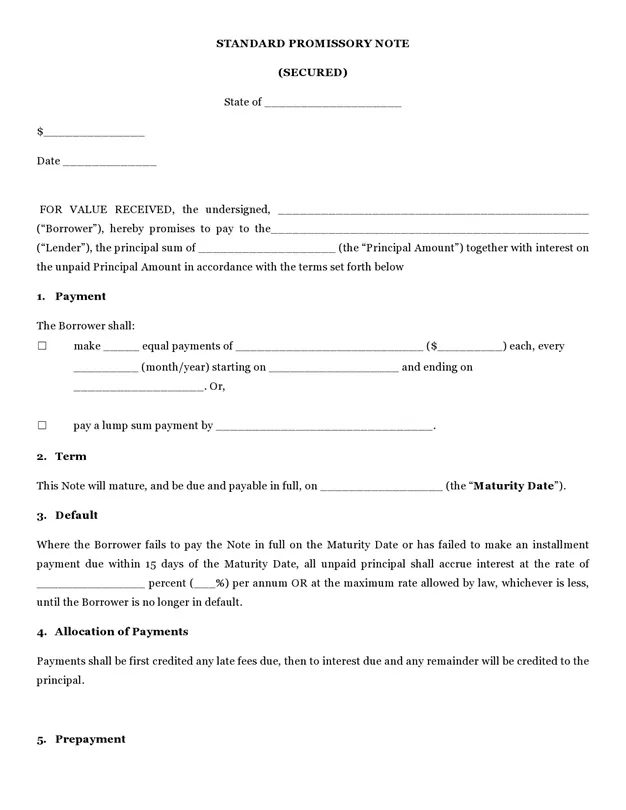

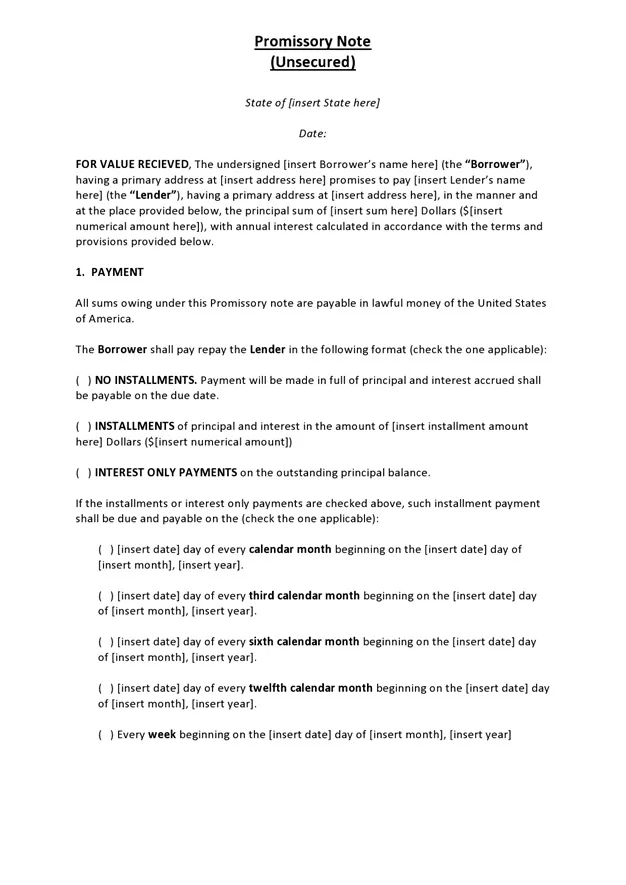

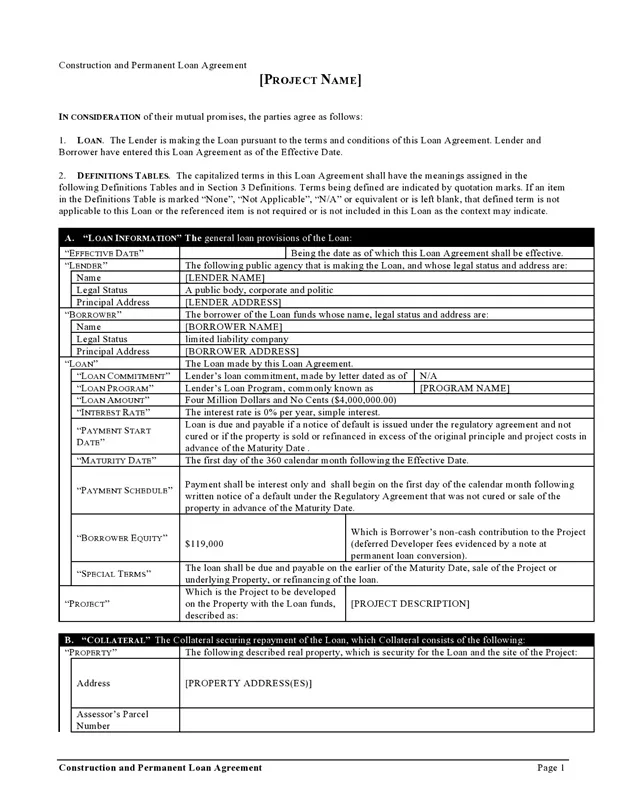

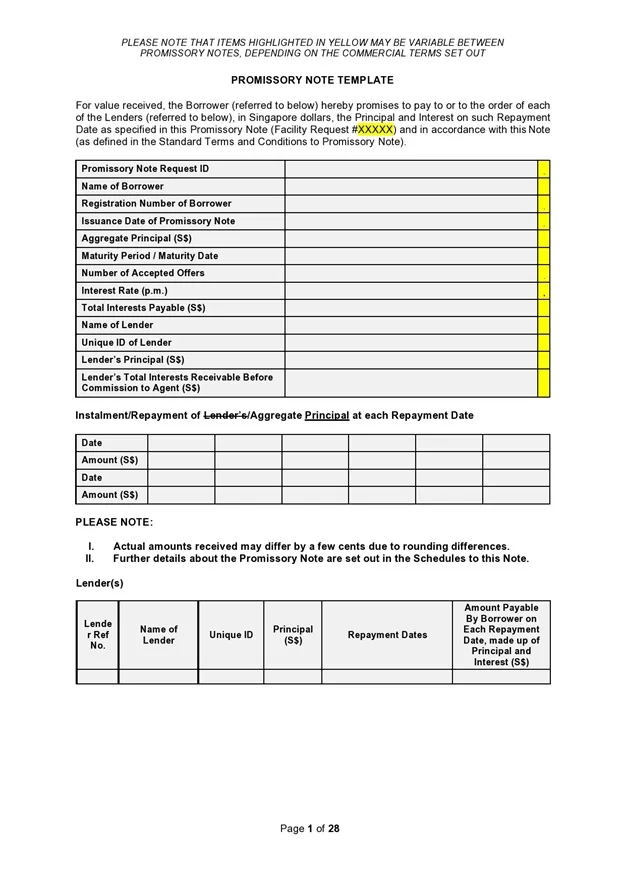

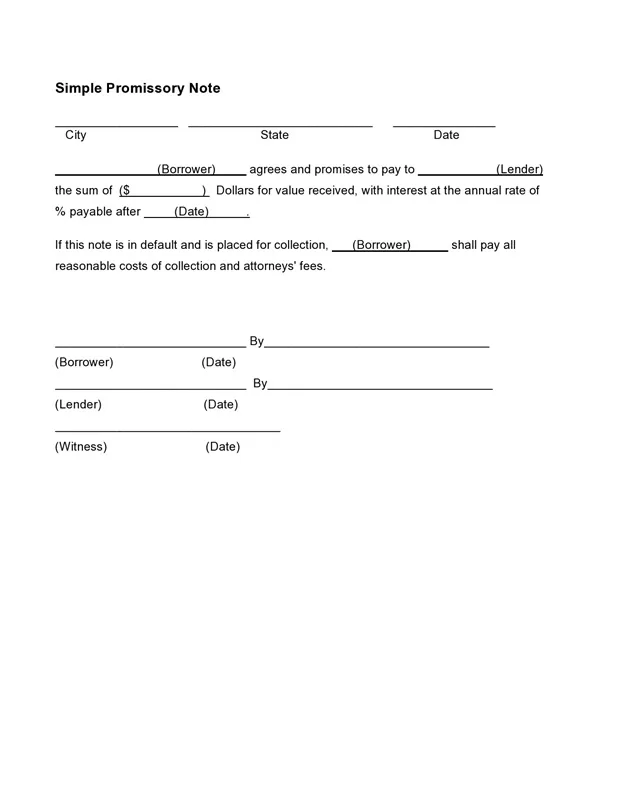

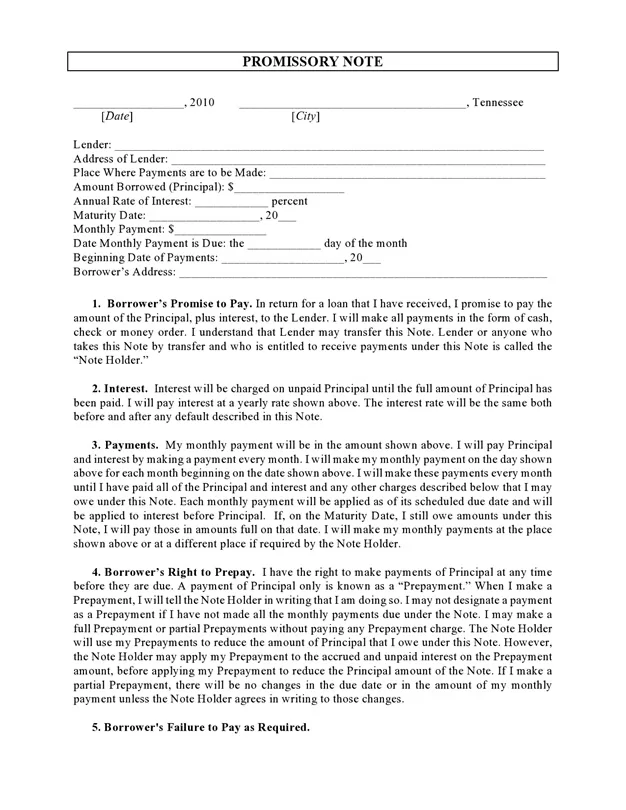

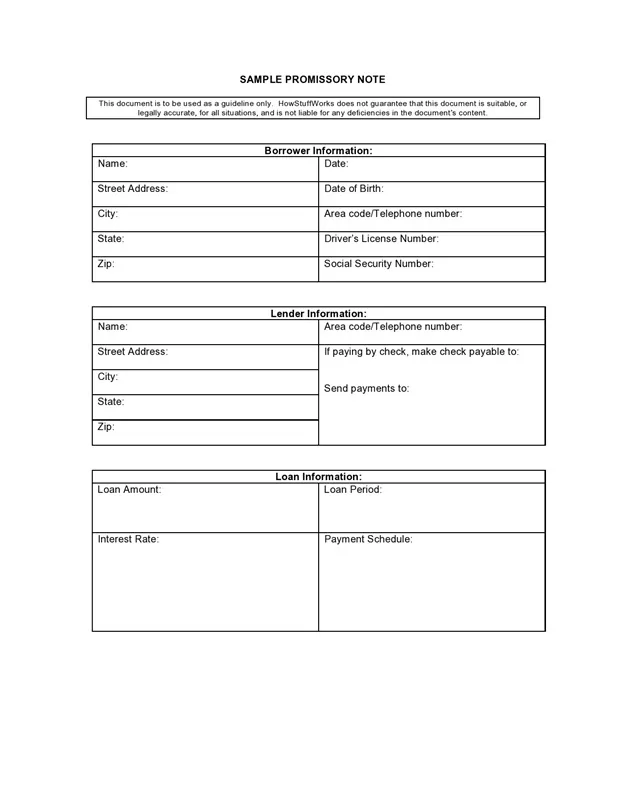

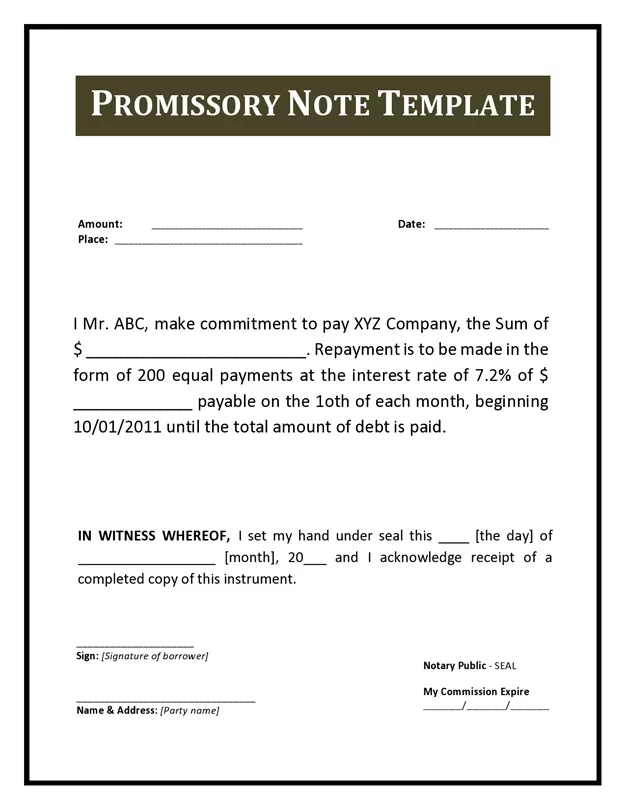

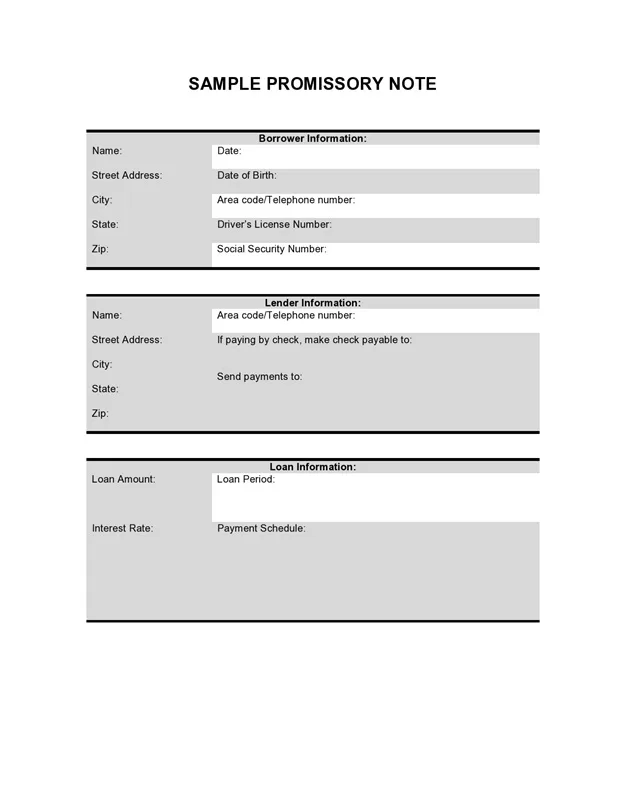

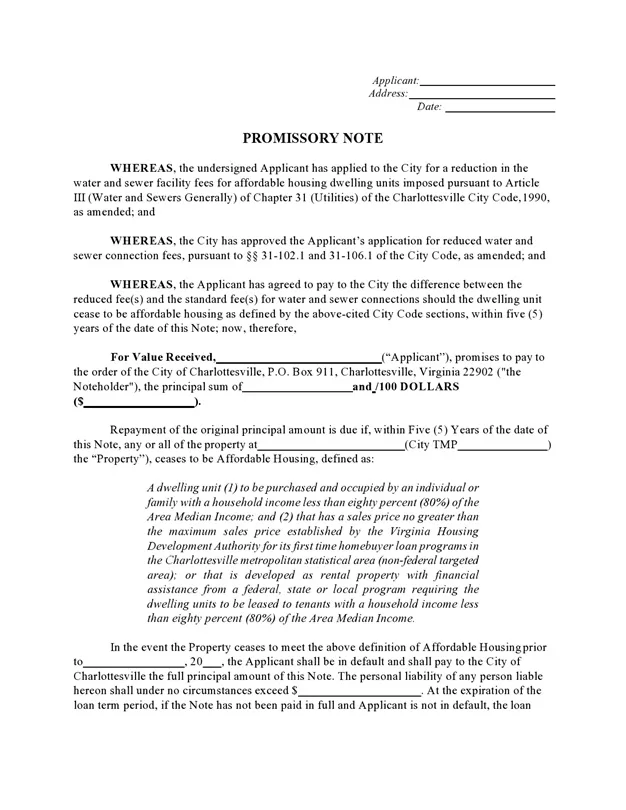

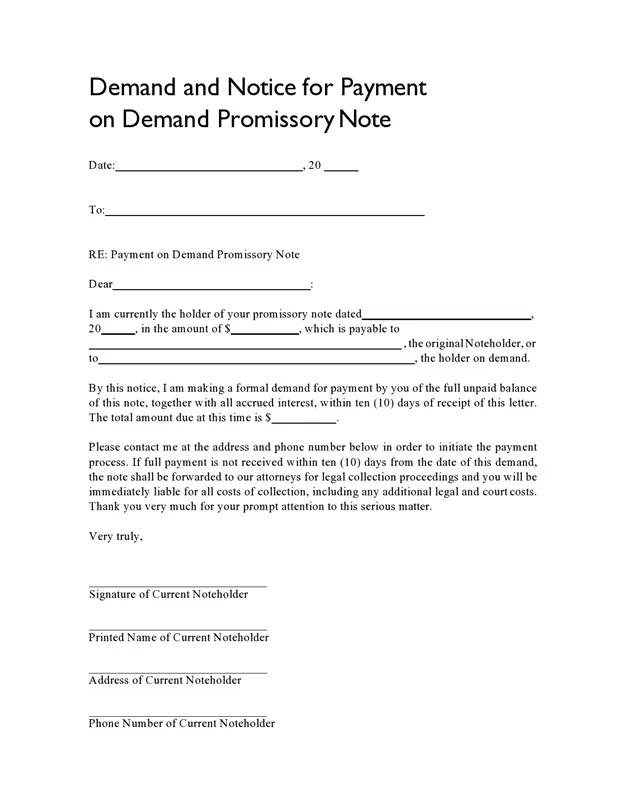

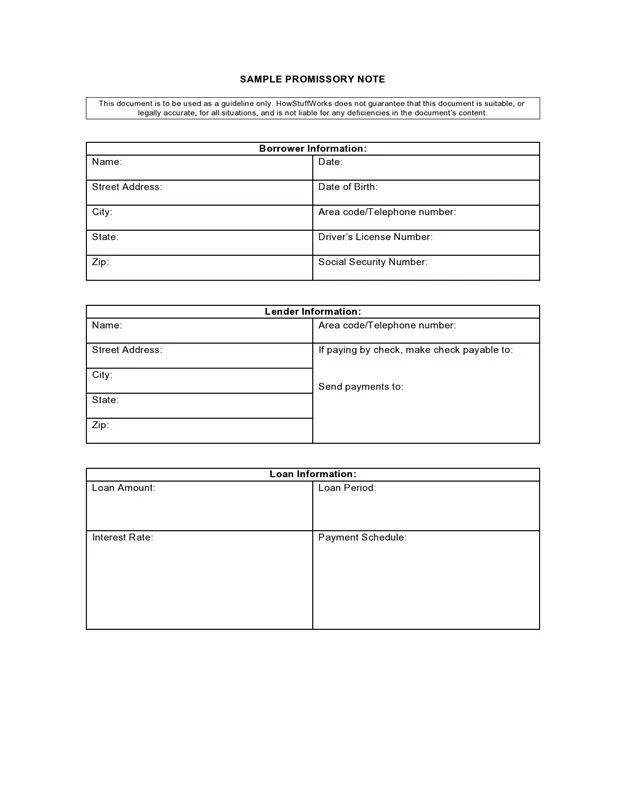

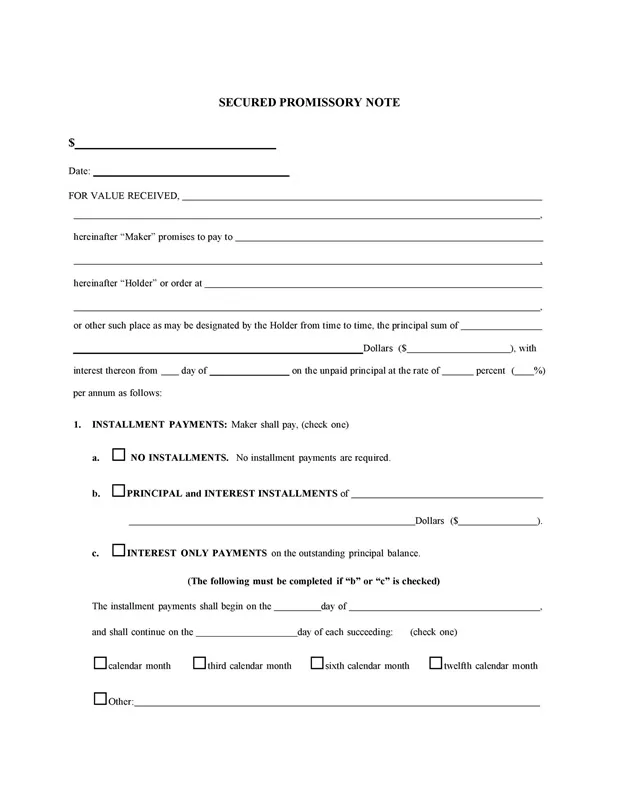

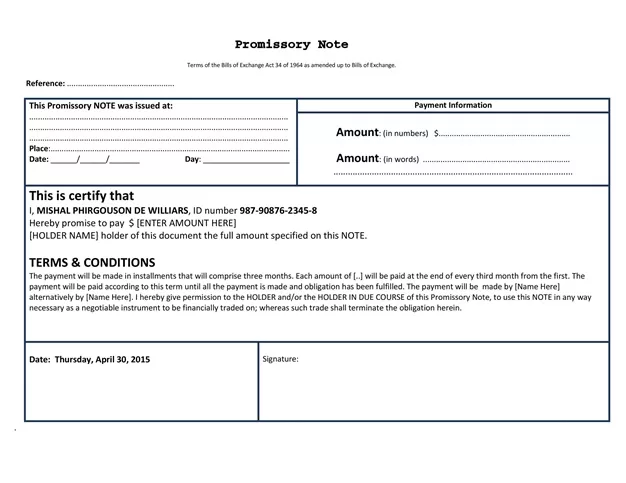

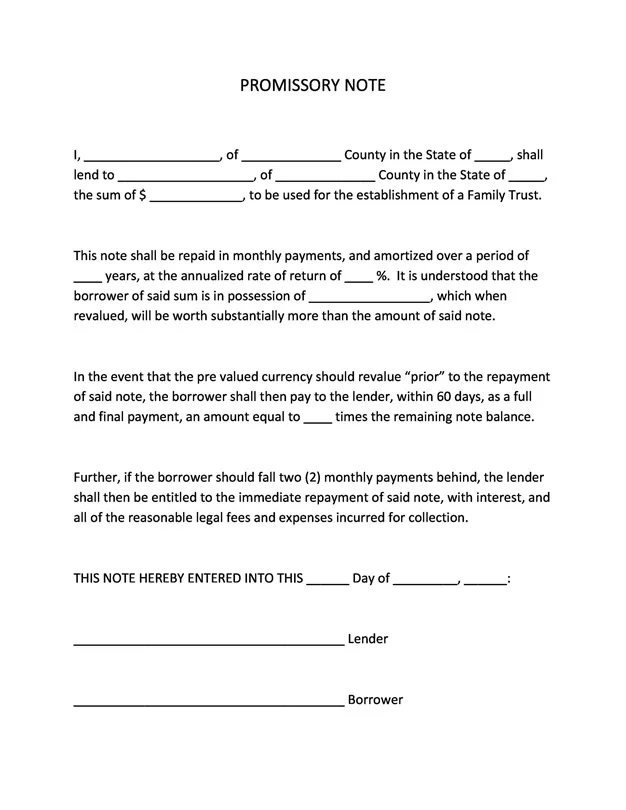

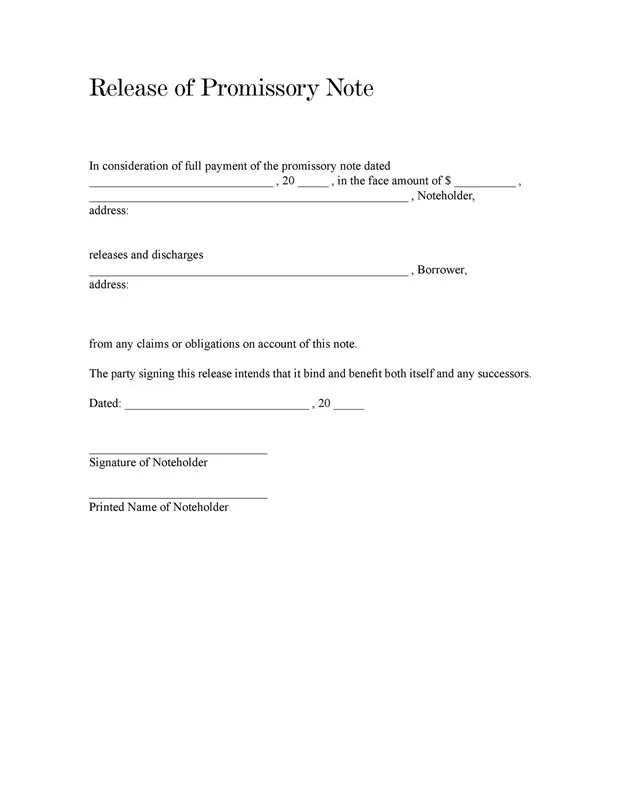

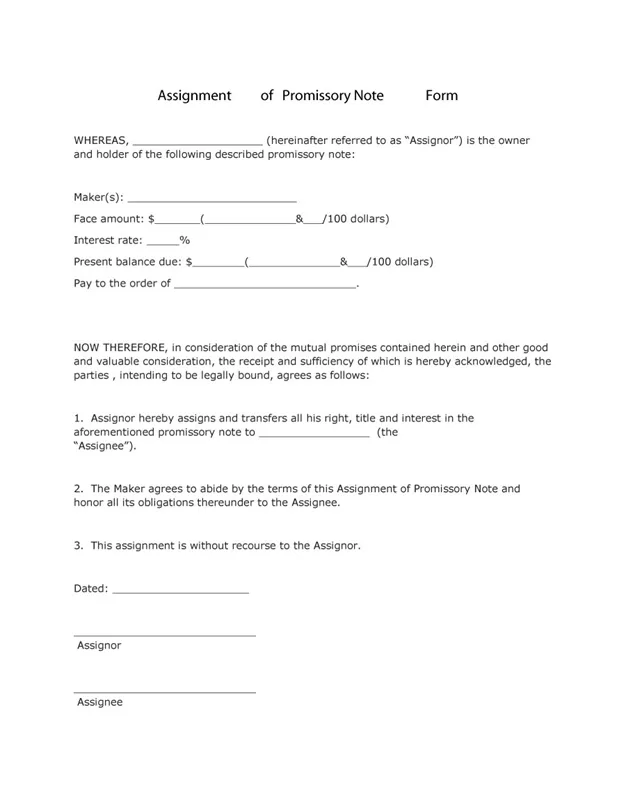

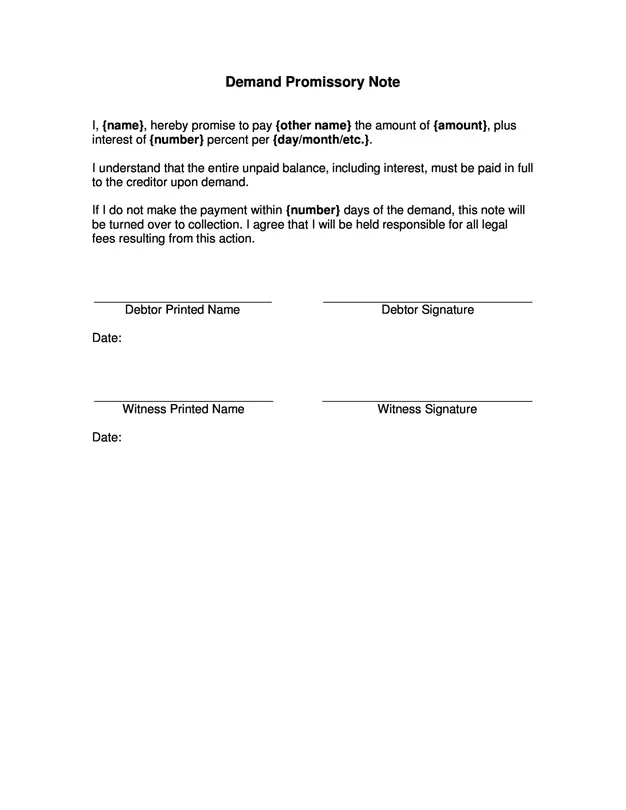

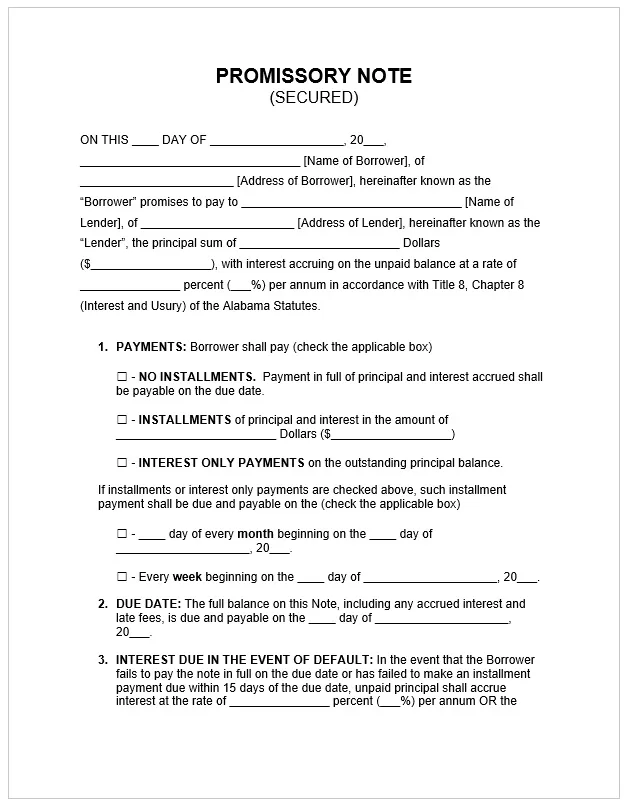

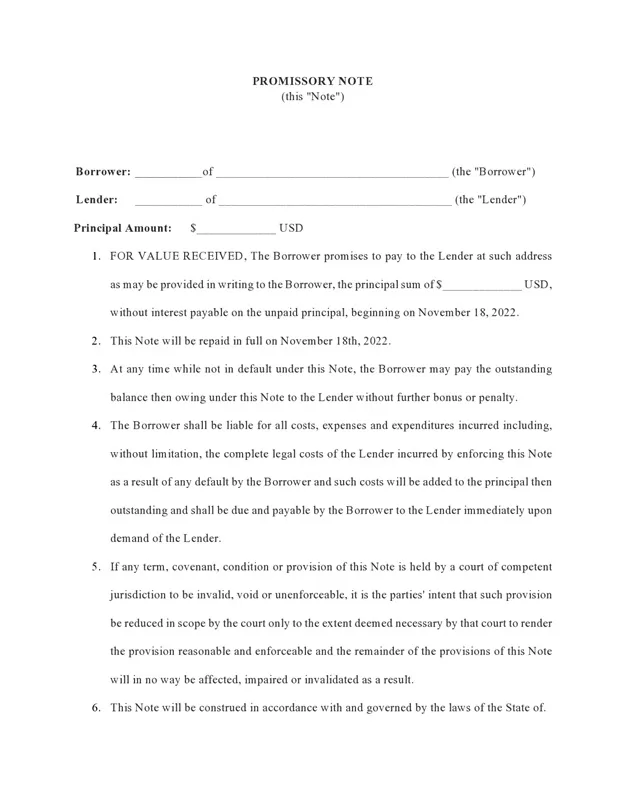

Here are previews and download links for these templates,

Types of Promissory Notes

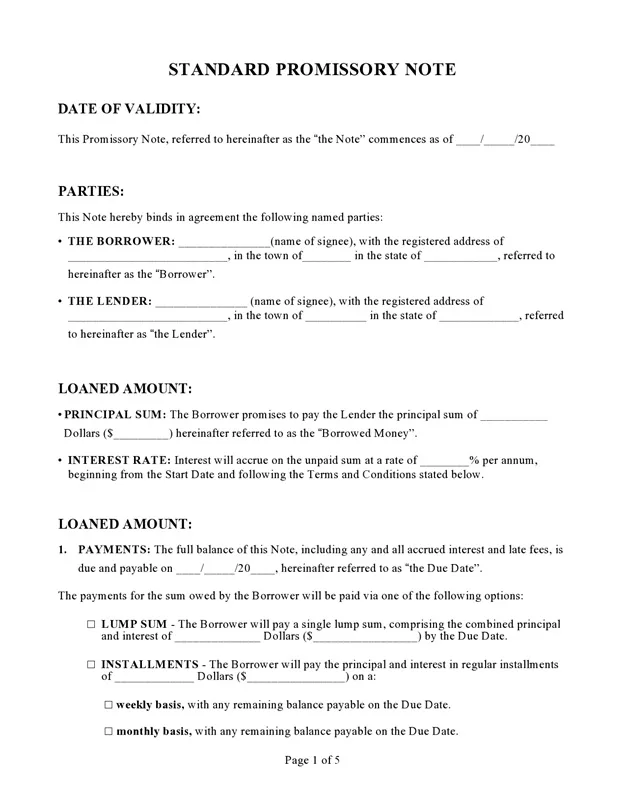

There are many different types of promissory notes that meet different borrowing circumstances and risk levels. The promissory note one chooses depends on the relationship between the parties, the amount of money borrowed, the method of repayment, and if there is any collateral involved. Knowing the forms promissory notes take enables lenders and borrowers to choose the form that serves their purposes with sufficient clarity and legal protection.

Secured vs. Unsecured Promissory Notes

Promissory notes can be distinguished on the basis of being either secured or unsecured. A secured promissory note, which is always backed up by the collateral-an asset security pledged by a borrower to minimize the risk of a lender. In the case of any default from the borrower’s side, the lender is entitled by law to claim the asset to settle the outstanding amount. Such types of a promissory note are common with loans that are higher on risk or very large amounts where the lender needs an extra security. An unsecured promissory note does not include any collateral but depends solely upon the borrower’s promise to repay. This thus becomes simpler but more flexible and risky for the lender. Typically, unsecured forms of promissory notes are used for personal loans or loans of lower value.

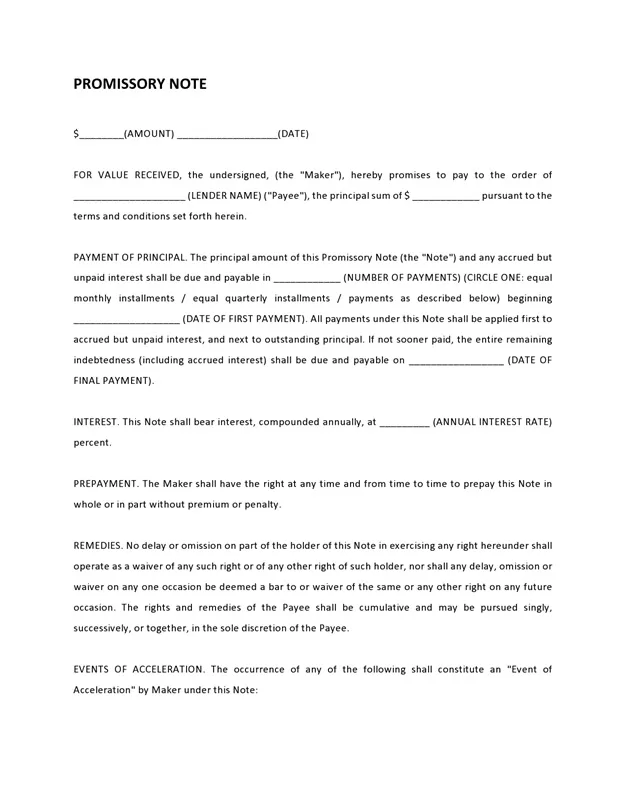

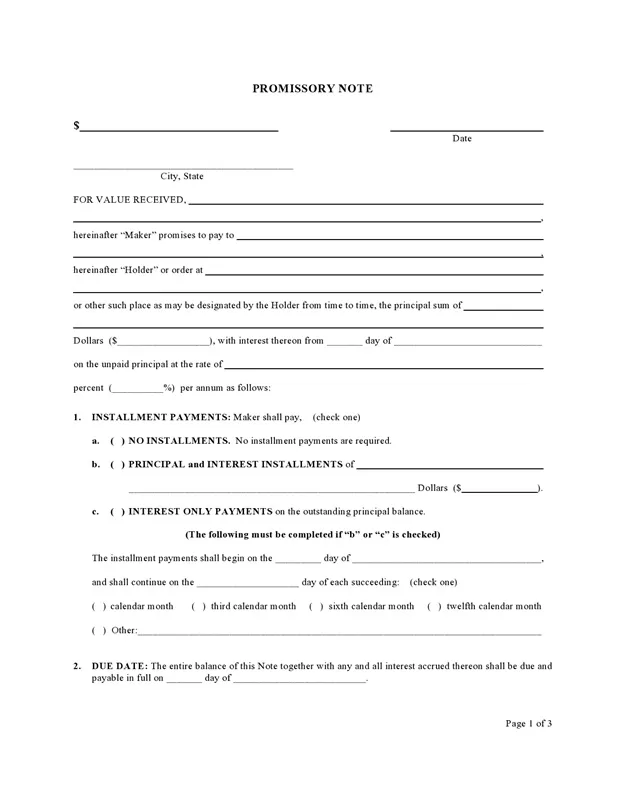

Demand vs. Installment Promissory Notes

Another major distinction is whether payment of the note is due on demand or in scheduled installments. A demand promissory note allows the lender to request full repayment at any time; it gives the borrower the most flexibility but requires a high degree of confidence between the two parties. An installment promissory note states specific fixed-payment terms and due dates, making them appropriate for structured repayment plans and long-term arrangements. Each of the two types serves different financial and relational purposes, and their selection is dependent upon the inclination and degree of confidence that exists between borrower and lender.

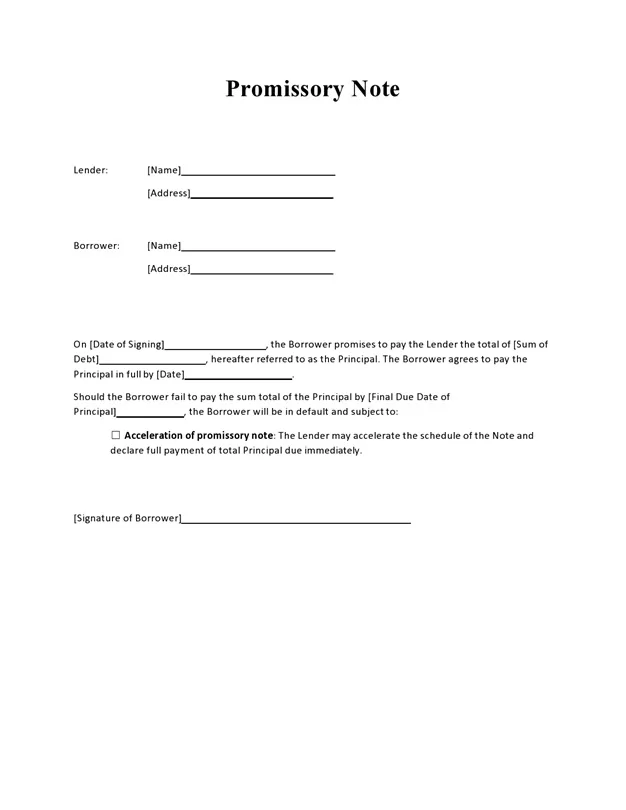

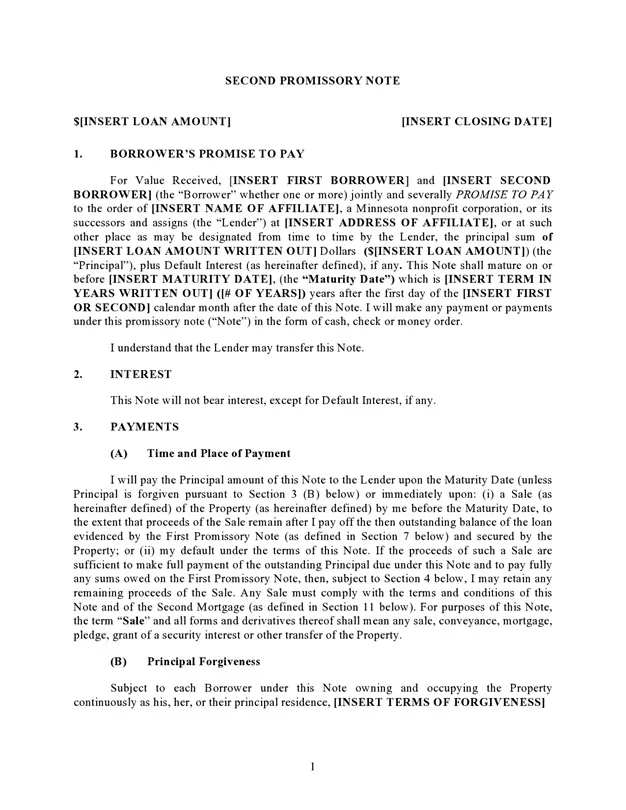

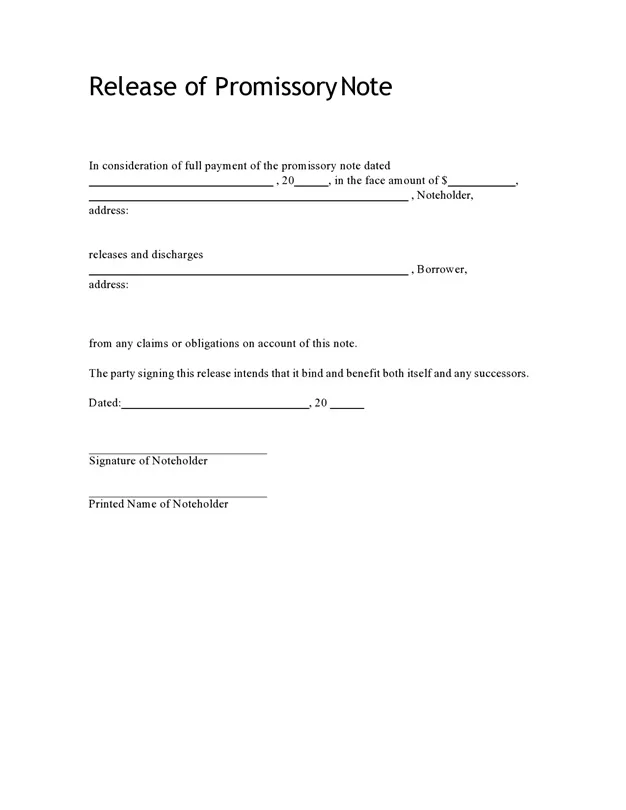

More Free Promissory Note Examples

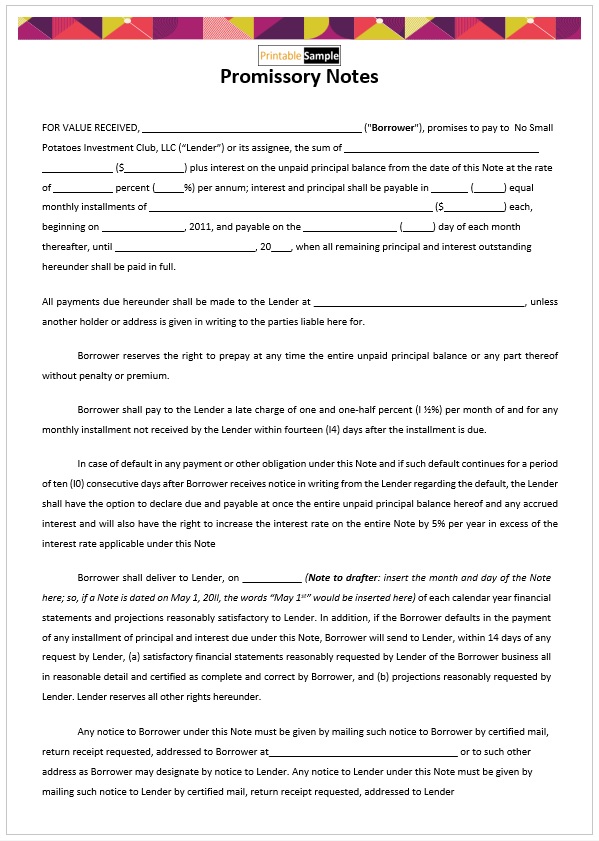

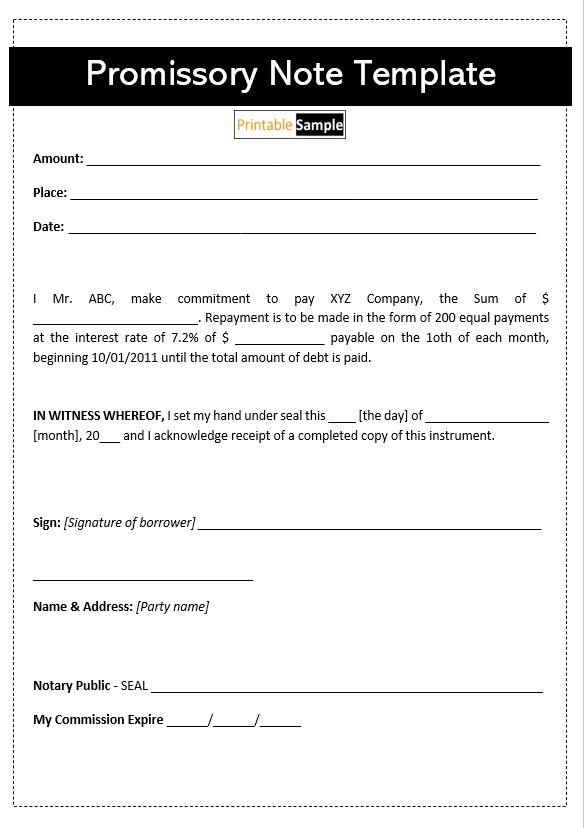

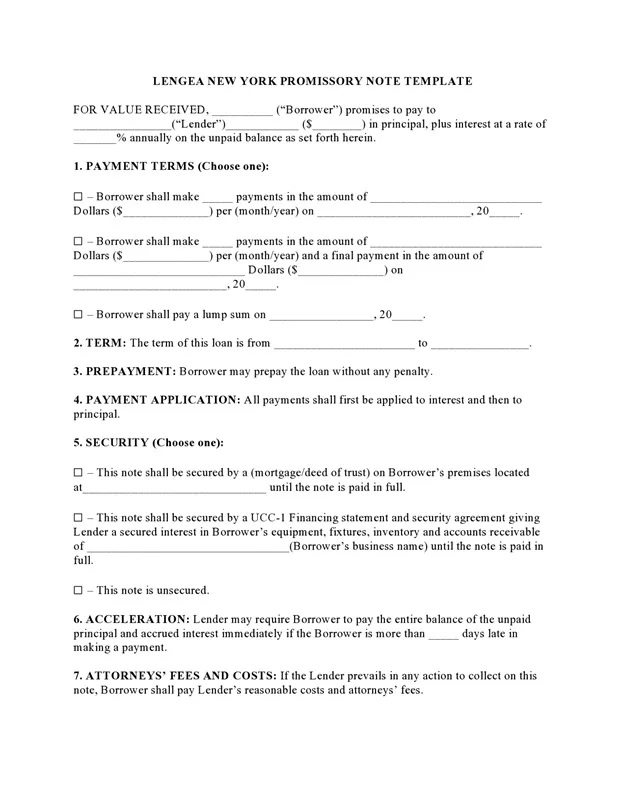

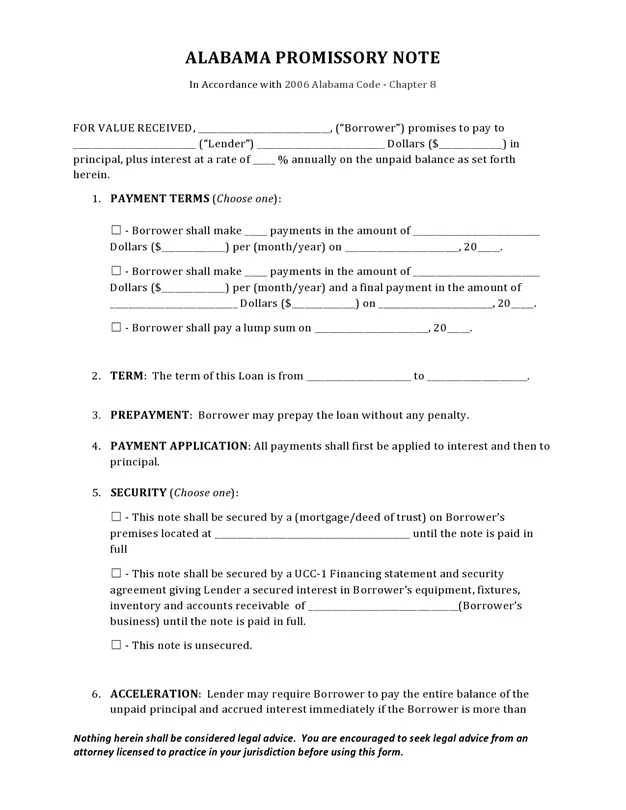

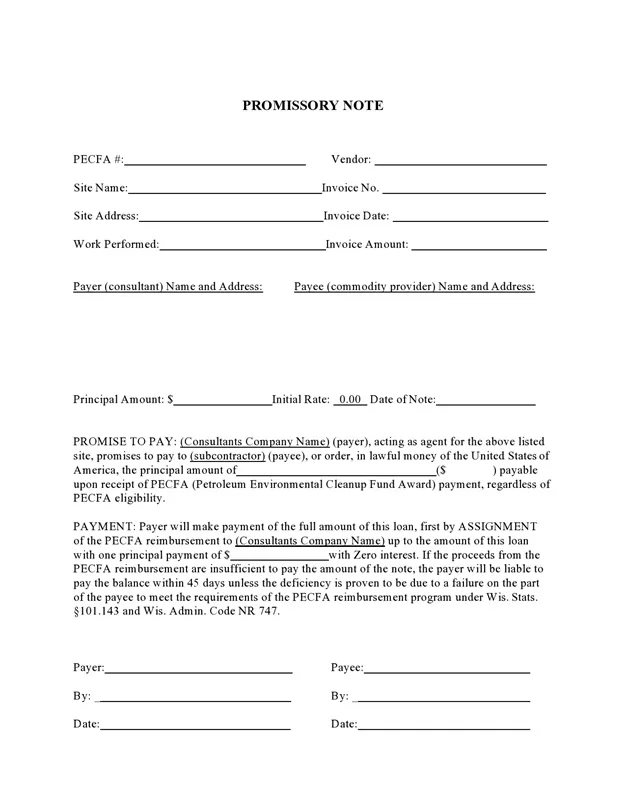

Here are previews and download links for these samples and examples,

When to Use Promissory Notes

When engaging in financial transactions involving loaning and borrowing of money, especially when precise clear-cut defined boundaries are very crucial, a promissory note comes in handy. Its advantage lies in the fact that it allows the completion of a contract that is legally valid and effective between the lender and the borrower, hence outlining in advance all the terms and conditions of the loan very clearly for purposes of later reference. Promissory notes are employed for many different personal and commercial making and receiving out of loans outside mainstream financial institutions.

Common Scenarios: Personal Loans, Business Financing, Real Estate Transactions

In terms of non-business-oriented financial interactions, promissory notes are commonplace instruments when individuals borrow or lend to each other so that there are no assumptions as far as the debt settlement is concerned. Such an arrangement ensures that there is less anxiety in both parties and a common ground between them as far as a personal loan is concerned, all factors such as the money loaned, the dates of repayment as well as the percentages charged are properly incorporated in short writing. In a professional environment, it is preferred to create promissory notes for the purposes of lending and borrowing within the partners or between partners especially investors and vendors catering to the scenario where small or start-up companies need easily accessible revolving funds only human sources are unavailable. These furnish adequate vehicles for preparing both short- and long-term financial arrangements among persons such as repayment through instalments or in one go.

When it comes to real estate transactions, it is rather common to employ promissory notes along with security agreements, by means of which the buyer undertakes to reimburse the cash borrowed for the acquisition of property. Such notes state the liability aven that they also help the lender on matters such as assurance. In any event where there is money being lent, there is always room for observation on the propriety of having a promissory note to address any alterations that may result in a conflict between the two parties for clarity of their deals.

Advantages of Documenting Loan Agreements

Promissory notes are very crucial for all parties involved as they give substance to a loan. They help a lot as whatever is involved in the transaction is put in words, hence every aspect is made clear to the parties concerned, keeping any conflicts at bay. In case of any default in payment, the lender can return to court, aided by the promissory note which indicates that there was a loan. The borrower on the other hand finds relief in the fact that from the onset all the constituents of the loan are clear, no additional stipulations come at a later stage of repayment and ensure all loan constituents are controlled.

The additional advantage is in helping bring order to informal understandings in the form of promissory notes. A great number of personal or minor business transactions start from mutual understanding, which is very easy to forget or misconstrue with time. With a promissory note that is in writing and signed, the parties take responsibility and operate with financial discipline. Serves to maintain friendships especially in lending situations where there is a need to lend, as it eliminates any possible confusion by clarifying matters.

How to Draft a Promissory Note?

It is crucial to construct promissory notes with a focus on the legal premises and precision since it is important that both the lender and the borrower are able to comprehend and consent to the lending conditions. A note when drafted correctly contains the duties of the borrower and it is an evidence of the agreement in the event of disagreement. There is some sort of order and certain elements that must be included for a promissory note to be enforced or in other words ‘to work’.

Step-by-Step Guide to Creating a Promissory Note

The initial step in formulating a process is to define all the parties that are the lender giving a loan and the borrower committing to repay the said loan. The names and addresses of both sides, as well as their contacts, must be filled in precisely. Then, the concern should be addressed by mentioning the amount of loan being extended in the note, and state any proposed rate of interest. It is important that this rate is stated on an annual basis and does not provide for a level of interest that is not not allowed in the respective jurisdiction. The way in which the money will be repaid, including the time period, number of payments, and the sums of such payments, should be contained in the note. Where applicable, the letter should indicate if payments are to be made in parts or in one go.

State the maturity date that is the time when everything has to be commercially repaid and state the punitive consequences for delayed or deferred payments. Also, if the promissory notes subject of clauses are backed up by guarantees, indicate which property is guaranteed and under what circumstances it can be called or, even better, explain how it is disposed. The last part involves the signatures of both parties and there is an instance that to make the document more legal, a witness or a notary is recommended.

Common Pitfalls to Avoid During Drafting

It is important to be careful with the words as well as inclusions of contradictory ideas to avoid possible litigation. Indeed, all such statements must provide clarity on every single fact in the agreement, as without such precision disputes turn into riddles. There are action components in a note that when they go missing as for instance terms on repayment or even the actual interest to be levied it becomes not actionable. In this context, various formats are available for drafting promissory notes which help in ensuring that the information is neither artificial nor sparse hence making the promissory note useful in any kind of lending agreement.

Legal Implications and Enforceability

Legally binding agreements often go beyond just a written document between two parties concerning a financial transaction especially when a promissory note is well crafted, executed, and signed by both parties. Every aspect of the promissory notes protecting the contractual interest of the parties to them, especially the borrower and lender, avails these parties a reason to know the above legal presumptions by understanding the nature and purpose of the note. The promissory note is clearly and properly structured such that if one of the parties defaults that will be considered as sufficient proof when a party goes to court to claim his/compliance rights.

Understanding the Legal Standing of Promissory Notes

Promissory notes must meet some conditions for them to be legally accurate. For instance, the note should stipulate the Approved principal amount, who the lender is and who the borrower is, the period the debt shall be paid and the final due irrespective of the amount. The lender and the borrower will then append their signatures as evidence that each party accepts. There may be other legal steps needed in different countries, such as a notary public or witnesses present during signing if substantial amounts or property are secured. Immediately a promissory note is signed, it becomes an agreement that can be entered into a court of law for resolution.

Steps to Take in Case of Default or Non-Payment

When a borrower defaults, a lender will be able to begin collection efforts, in accordance with the terms of the note. This process can start with legal notices and end up in small claims or civil court. A well structured note contains provisions concerning defaults, for example, late fee, punitive interest or in secure transactions confiscation of amendment measure. Promissory notes are generally approved by courts and as such are very effective in collecting debts as well as compelling parties to adhere to financial obligations.

Alternatives to Promissory Notes

Promissory notes generally work well as they are designed to formalize a particular loan agreement. However, some different document or forms may be more appropriate depending on how complex the transaction is. Knowing the alternatives is important as it enables the lender, borrower or both to decide on the correct and appropriate agreement for the particular understanding – loan, especially in view of the fact that lending obligations have to be crystal clear and well defined in law.

Comparison with Loan Agreements and IOUs

Unlike promissory notes, a loan agreement is a broader and more refined document. It covers more grounds such as representations and warranties, default clauses, dispute resolution clauses and the specific duties of the two parties to the agreement. Such loan agreements are necessary mostly when conducting business at the corporate level and where the loan in question is much bigger in amount, to be disbursed in phases or to be repaid over a long period. Loan agreements are also frequent in institutional lending arrangements where law is key and minimum social responsibility exists.

Promissory notes, on the other hand, are more elaborate versions of IOUs. They not only state that one party owes another a specified amount, but they also contain clear terms of repayment, and can be legally binding, unlike IOUs. As compared to IOUs, promissory notes are often used when the parties happen to be close relatives or very close friends who trust each other. Still, such documents are rather unstructured and not legally enforceable, which limits their use to small and simple debts.

Determining the Appropriate Document for Different Lending Situations

The selection of the proper tool is a function of the significance and type of loan as well as the market context. Promissory notes are useful and provide legal certainty in cases of relatively easy to understand loans, be it between individuals or businesses. Despite that, if more complicated and risky cases exist, a complete contract is desirable instead. Use IOU’s only when the cause is very simple and does not bear any responsibility. There is a provision of, and every case requires, promissory note(s) or other agreements, however, the function of this is defined backwards and by merit asked and given by a person himself.

Best Practices for Using Promissory Notes

Promissory Notes can be useful and practical for recognizing debts, however, it should be mentioned they depend on the quality of making out, signing, and the level of respect for them. It is necessary to take precautions to avoid ambiguity when stipulating the provisions of the loan as well as ensure that the provisions of the contract would be enforceable. Loan transactions may be carried out by individuals or businesses but even if these are people or businesses, adherence to them would enhance professionalism and protect the transaction.

Ensuring Clarity and Completeness in Documentation

It is imperative that promissory notes identify each involved party and the sum of money being lent precisely. Omitting sections or using ambiguous language risks the contract’s enforceability. It is considered a sound practice to state the loan participants’ names and surnames, the lent sum of money, the interest rate, the terms of repayment (i.e. how many repayments and the sum per repayment), the dates when the payments will be made and any sanctions in case of delay. When it is a secured note the detail of all charged securities should be provided including the conditions of debenture holder seeking any security. Consistency of terms and precision in the financial figures such as structure of interest or repayment is crucial. It is also recommended to refrain from using a too specific law language that could confuse the nonlegal understanding individuals.

Recommendations for Lenders and Borrowers to Protect Their Interests

The signed promissory note should not only be held in safekeeping at all times, but a notarized copy should also be kept for it carries more weight. All payments made, together with respective dates and figures, should be recorded in order to check compliance and also for future reference when any argument ensues. As regards the borrowers, they should take time to comprehend all the conditions and, where necessary, ask for explanations in respect of all unclear provisions. Additional requirements, if any, can be considered for loans, which are either too big or will exceed a specified period.

It’s important for both sides to discuss freely about this loan and record all amendments in a written form. Any amendments should be properly accounted for in an addendum, signed by both parties, to ensure the validity of the contract. Emphasizing on the significance of transparency, accuracy and accountability in the process of dealing with promissory notes, lenders as well as borrowers can rest assured that the promissory note is a legitimate, rational or enforceable agreement.