A Cash Voucher Template is a standardized document used to record and authorize cash transactions, such as petty cash disbursements, reimbursements, or cash advances. A voucher for cash payments, or better known as a cash voucher, is more of a corporate function. Cash vouchers are primarily used however as proof that money was spent with a valid business intent and, therefore, become a part of the company’s accounting records. Payment vouchers are extremely common in businesses for purposes such as reimbursements, petty cash disbursements, purchasing office stationery, among other miscellaneous business activities. These so called “receipts” also act as checkmating operations as they include the payee, the purpose, and the approver.

Contents

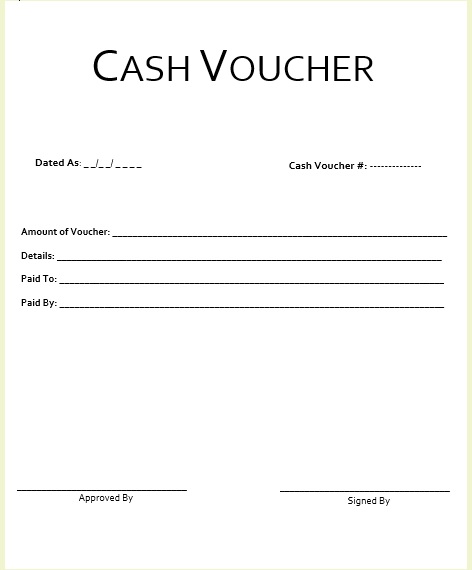

Anatomy of a Compliance-Ready Cash Voucher:

Often people think a cash voucher is nothing but a type of payment slip in reality it is a formal financial control tool which is issued to support and track any sort of cash payment and to prevent any misuse. Sample includes petty cash, bills, advances, or any instance that involves on paying in small businesses. A properly designed cash voucher should provide lists for each of the items of the expense without compromising clarity or if possible at all cost avoid fund double spending problems. Each voucher must be designed and documented in advance, and the format must be used for controlling already approved centers.

Key Information Every Voucher Must Contain

In any case, any cash voucher should at least consist of a unique voucher number or any other means of identification, the date of issue as well as the name of the person/vendor to whom payments are being made. To cater for excessive payments or unauthorized account classifications, the necessity for stating and the mention of payment purpose which includes the relevant account or expense category is provided. Also, the total payable amount should be in numbers as well as in words to stifle manipulation and fraud. Expenses description in detail is essential for each of them remit a particular invoice or a bill otherwise the challenge is attached head on. Several lines at the bottom of the accounting form should be signed by the individual requesting money and the person paying it, usually a supervisor or a finance officer, as well as the cashier or custodian who pays out the money. When these features are contained in a template for the voucher then companies have supportive documents to their internal controls and will not strain in future auditing.

Cash Voucher vs. Payment Voucher vs. Petty-Cash Voucher

In the corporate world, and more so for small business or office environments, these three documents are often confused while they each allude to a different accounting function. It is prudent to illustrate the difference between what is called a cash voucher, a payment voucher, as well as a petty-cash voucher for purposes of proper record maintenance and simplification of halfway approval process. A voucher serves a function for each of these purposes – it helps to capture expenditure, promote accountability and control any misuse of money.

Cash Voucher – The General Purpose Document

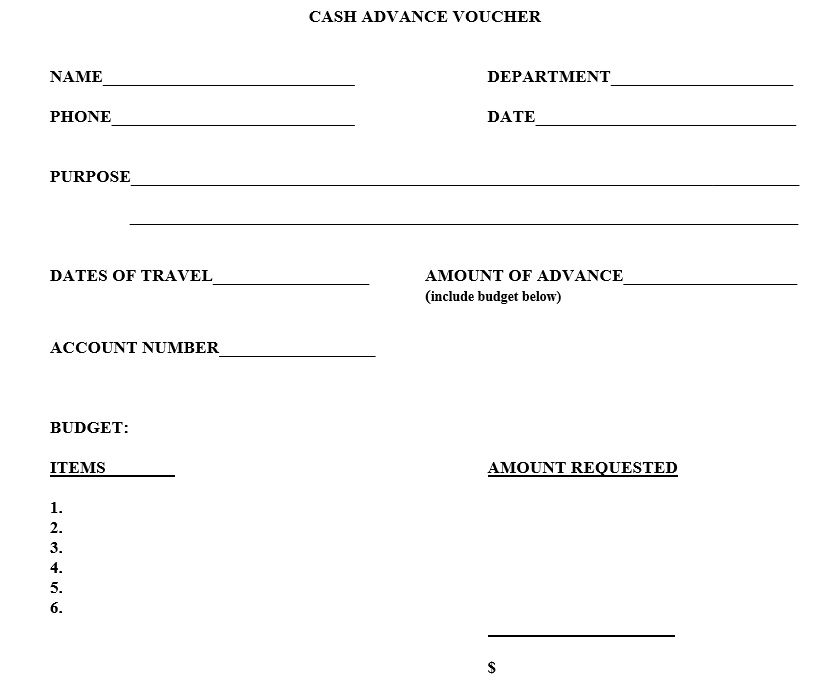

A particular type of financial documentation, a cash voucher is used with the aim of recording cash payment into/out of a company. A cash voucher may be provided for reimbursements, cash advances, Exceeding purchase limit, costs, among others. It serves as an evidence of payment within an institution and remains in the books together with other documents that constitute an audit trail.

Payment Voucher – Linked to Accounts Payable

Payment vouchers are formal documents and are rendered when payments in respect of bills or invoices are made, typically by the accounts payable department. It typically contains the information of the supplier, invoice numbers, as well as a finance department endorsement. As opposed to a simple cash voucher, it is inextricably linked to purchase orders and confirms that payment has been made to meet a classified financial requirement.

Petty-Cash Voucher – For Small Daily Expenses

When making small and necessary payments such as for covering expenses for internal purposes, snacks, and even attending conferences as is the case with a cash voucher , a Petty-Cash Voucher often comes as comparatively effective. This is the function of the petty cash, and it motivates such small expenditures to be accounted for appropriately. Each petty cash voucher is meant to be used in restoring the balance of the petty cash box.

While all three documents support financial accountability, choosing the correct voucher type ensures clearer categorization, better approval tracking, and improved compliance with internal financial policies.

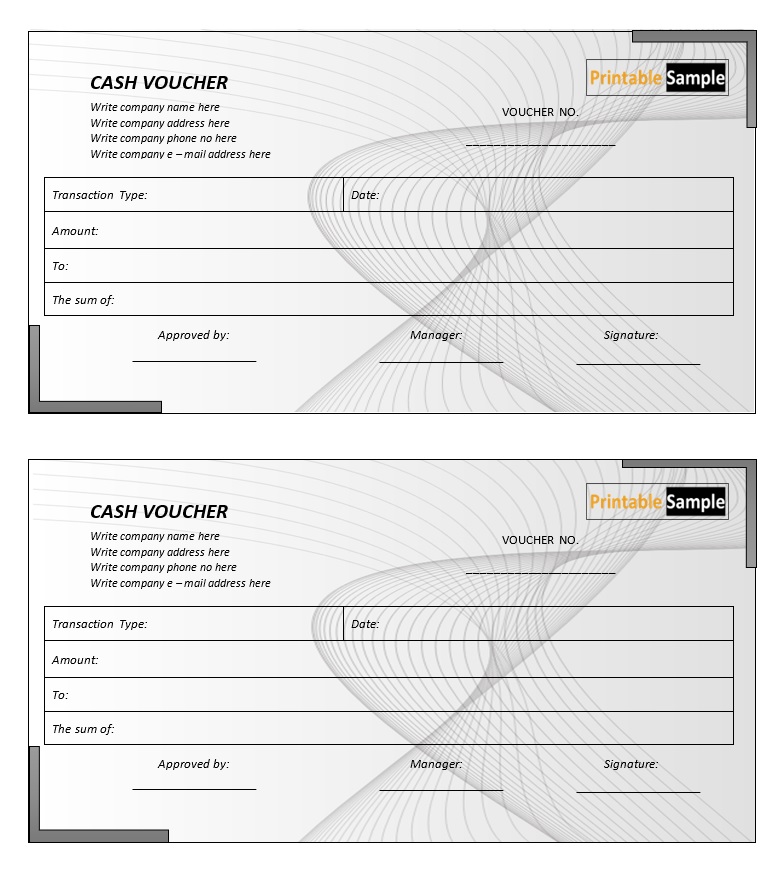

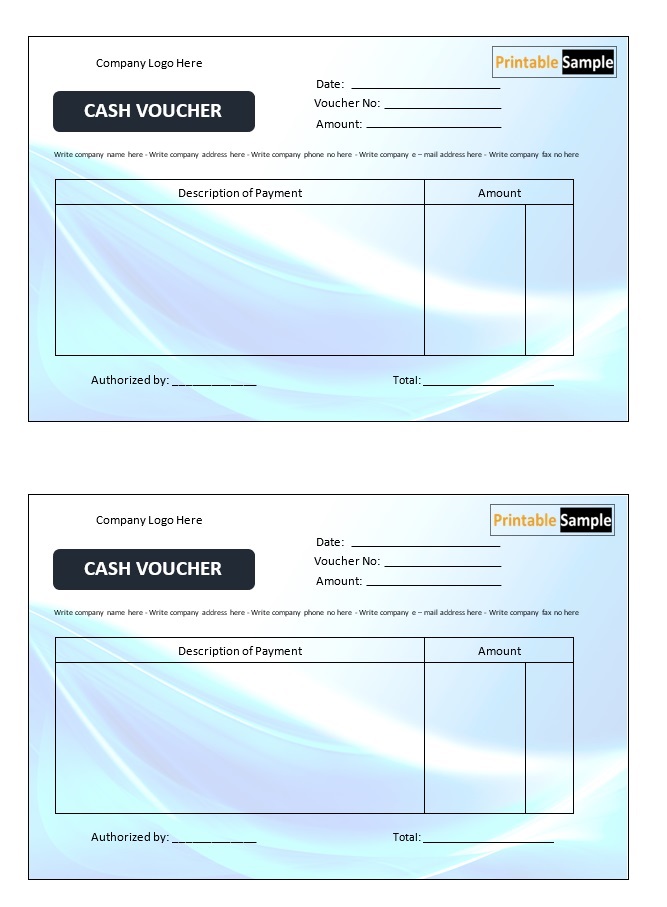

Free Cash Voucher Templates (Exclusive):

Here are previews of 10 Free Cash Voucher Templates prepared in MS Word by our staff to assist our website visitors.

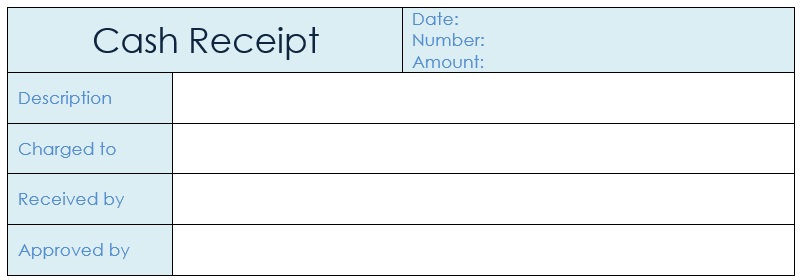

Generally, most businesses and individuals conduct business transactions on a credit basis. This means that even if the customer receives the goods or services from the vendor, he doesn’t pay for the items immediately but takes some time to arrange for the payment. Usually, there is a 30-60-day period for making credit payments and when the payment is made, a document is created known as a cash payment receipt. This receipt proves that the vendor has received a certain amount of cash or equivalent from the customer.

Importance of cash payment receipt:

It’s clear that individuals i.e. clients or customers make partial payments to the vendors while they keep buying new items or products. This means their account ledger is always changing so as soon they make some payment, they should have proof that the vendor has received the payment and their account has been credited. Another important factor of the cash receipt form is that if the customer or client wants to return the product or has a complaint against the services received, he can use the cash receipt to contact the vendor and start returning process. In the same scenario, if the item or product is under warranty, the vendor will ask the client to present a cash receipt form for claiming warranty service or repair. Most of the important factors in preparing a cash payment receipt is to update the account of the vendor on a regular basis so both parties who what’s the status of the account i.e. how much amount is owed by the client.

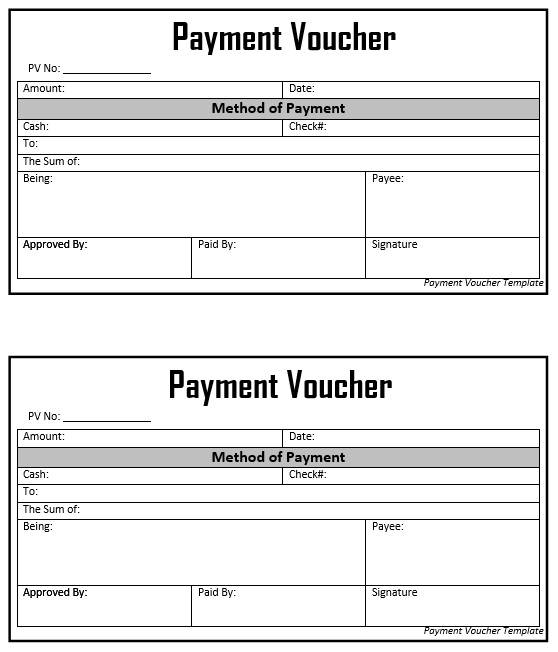

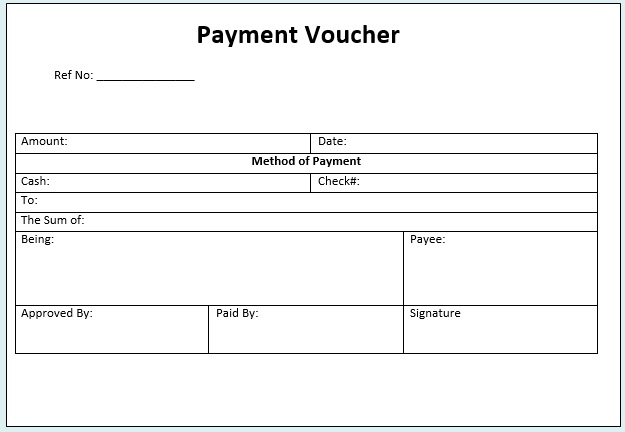

Free Cash Voucher Templates (Public Domain):

Here are 8 more Free Cash Voucher Templates hand-picked to facilitate our website visitors.

Guidelines to create Cash Payment Receipt:

- Details of both parties:

A cash receipt is not considered complete unless it includes full details of both parties that are involved in the business transaction. Usually, there is the vendor or manufacturer who provides products or services and the customer or consumer who purchases the services or goods. The cash receipt must include their names, contact details, and addresses. - Date of preparing the receipt:

Either talking from the accounting department’s point of view or for taxation purposes, it’s really important that the date on which payment is received from the customer should be mentioned on the cash receipt. Most of the time when companies do business on credit terms with the clients; there is a penalty fee for late payments i.e. 10% after passing 1 week of the due date etc. This is why it’s important that the exact date of receiving the payment should be mentioned on the receipt. - Amount and method that is paid by the customer:

The next part of the cash payment receipt should include the amount that the vendor has received from the customer. Keep in mind that when a cash receipt is prepared, the original copy is given to the customer or client while the vendor keeps a photocopy of the document. Along with the amount that the client paid, the method of payment should also be included i.e. check, cash, bank transfer, or bank draft. - Description of goods/services:

On the cash receipt, the vendor should also mention the description of the goods or services that he provided to the client against which the client has now made the payment. It doesn’t matter what sort of services or products were provided to the client and the cash receipt should include at least the basic information of the goods for record keeping purposes. - Balance payment:

At the end of the cash receipt, you should mention the balance amount that is still owed by the customer or client. It is very common that when clients do business on a regular basis with vendors or manufacturers, they don’t just pay the entire amount at once but make periodic payments which means after each payment, there is still some amount they owe to the vendor. The cash receipt should include the balance amount after adjusting the received payment.